In modern conditions, many prefer to work remotely without the need to go to the office daily. More and more freelancers from Russia are considering employment abroad with the possibility of permanent residence. And this preference is provided by countries in the EU, Asia, Africa, and South America.

Compatriots working online analyze the prospect of moving to the Eurozone, but to legally live and work in one of the Old World’s states, a remote worker needs a freelance visa. This type of entry permit is issued to both employees and bloggers, as well as representatives of free professions (artists, musicians, photographers, actors, etc.).

Applicants who have been approved for a freelancer visa receive temporary resident status (residence permit) upon arrival in the country. It provides access to high-standard education and healthcare, the ability to optimize the tax burden, the preference to travel across the EU without bureaucratic barriers. Additionally, the status allows them to bring their relatives to the country and eventually qualify for a European passport (subject to certain migration law requirements).

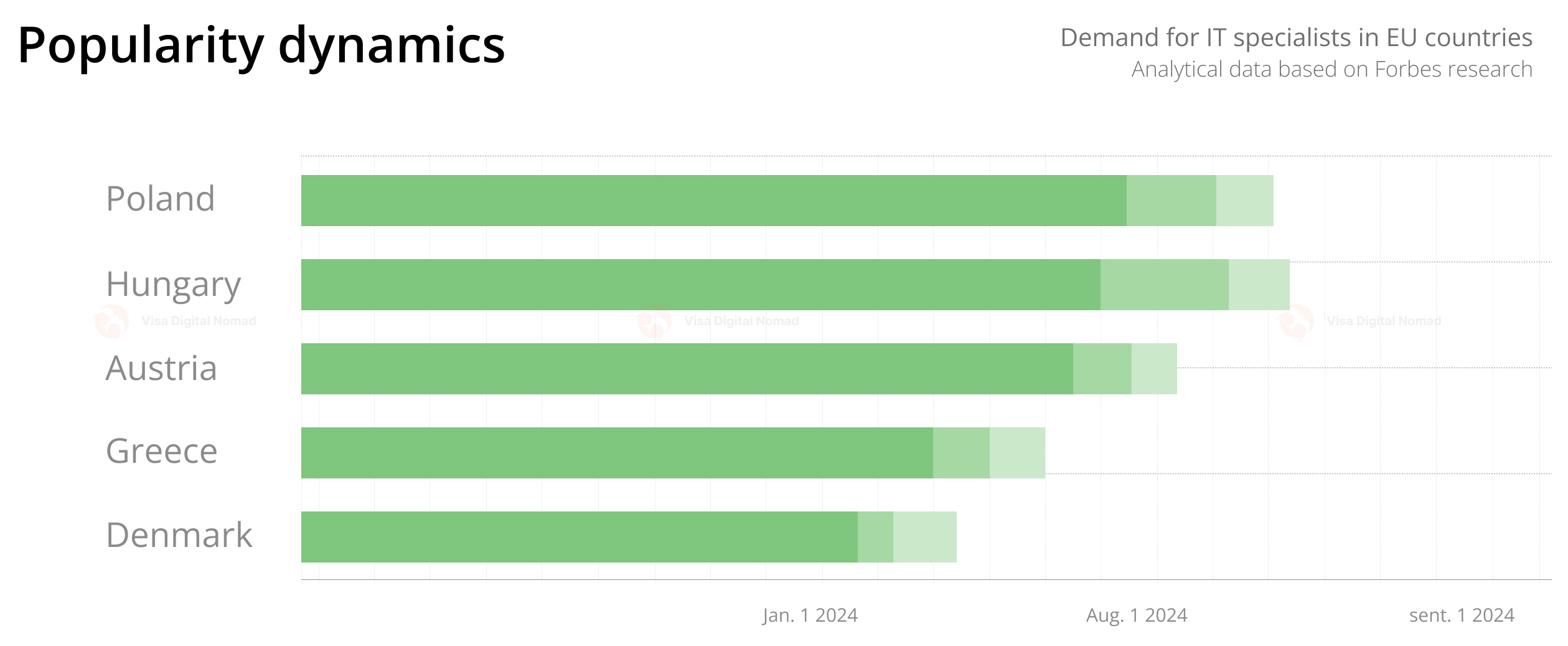

The data is based on a Forbes magazine study on the dynamics of demand for IT specialties in Schengen countries and the development prospects of this industry.

Main requirements for obtaining a freelance visa

To become a holder of a freelancer visa, you need to meet the criteria provided by the internal legislation of the state. Their list varies in each country. For example, in the UAE, a remote worker can work provided they obtain a license for the relevant activity and only within the chosen free zone. There are no such conditions in the EU. However, general requirements for digital nomad visa applicants can still be highlighted.

Minimum income

The authorities of foreign states are interested in the constant replenishment of the budget, including through taxes received from freelancers. But they must be sure that in the new place, remote workers will be able to meet basic needs. There should be enough money for renting housing, paying for utilities, buying food and clothes. In some countries, the indicator of minimum sufficiency is tied to the minimum wage (SMI/SMIC)

- In Spain, a freelancer must receive an amount equal to 200% of SMI (1,323 x 2 = 2,646 euros).

- In Portugal, the minimum wage is set at 820 euros (increased since 1.01.24).

Legislation in some countries may not specify an exact minimum income for remote workers but may instead require them to have sufficient financial resources to live in the country throughout the calendar year. In the latter case, the final amount is determined by analyzing housing costs, the cost of a food basket, and other parameters.

Employment Contract or Portfolio

The immigration laws of most European countries prohibit freelancers from signing employment contracts with local employers. Income sources must come from abroad, and to ensure this, authorities require remote workers to provide an employment contract that specifies not only the company’s field of activity but also the remote worker’s job responsibilities.

A freelancer can prove the absence of employment relationships with local companies by providing a certificate of registration of the employer company. This practice is provided for, for example, in Hungary. To confirm their qualifications, representatives of free professions may be required to provide samples of their best work. A portfolio will also be useful when seeking employment in a country whose immigration laws allow for the possibility of signing a contract with local employers.

Documents Confirming Financial Stability

Financial stability is one of the main requirements for obtaining a freelance visa. The most common way to prove financial stability is to provide a bank statement showing the movement of funds for the reporting period (from 3 to 12 months).

An alternative document is a certificate of salary (2 NDFL). Contracts with employers (clients) or receipts as proof of payment for services rendered can also be provided. The freelancer must convince the consulate representatives that they will not resort to odd jobs in the host country.

Authorities of any country with a digital nomad program do not want to increase the risk of an influx of illegal immigrants, which could exacerbate the problem of unemployment among the local population. Officials are also interested in ensuring that the freelancer spends their earned money in the country of permanent residence.

Which Countries Offer a Freelance Visa in 2024

| EU Country | Minimum Income Requirements (per month, euros) | Visa Validity | Family Members Included in the Program |

| Hungary | From 3,000 (+10,000 personal savings in a bank account) | 1 year (with the possibility of extension for the same period) | No |

| Italy | From 2,700 (+30,000 personal savings in a bank account) | 1 year (with the possibility of two extensions for 2 years) | Yes |

| Greece | From 3,500 | 1 year (with the possibility of extension up to 3 years) | Yes |

| Romania | From 3,700 | 0.5 years (with the possibility of extension for the same period) | Yes |

| Czech Republic | From 5,587 euros in personal savings in a bank account | 1 year (with the possibility of extension for 2 years) | Not always (at the discretion of the authorities) |

| France | From 3,000 | 1 year (with the possibility of extension for the same period) | No |

Personal Experience and Tips

When choosing a country for remote work, a freelancer should analyze the specifics of its migration policy. As mentioned earlier, each state has the right to impose individual requirements on remote workers. In some countries, freelancers can live for quite a long period on a tourist visa, periodically extending it. Serbia and Montenegro have a visa run procedure, which allows a digital nomad to leave and re-enter the country after 1-2 hours.

According to experienced remote workers, one of the most attractive countries for online work is Spain. Those who are self-employed and provide services to foreign companies remotely have the best chances of obtaining a freelance visa in the Kingdom. However, while in Spain, a freelancer can collaborate not only with foreign employers but also work for local ones (with the sole stipulation that in the latter case, the combined share of monthly earnings does not exceed 20%).

To obtain a freelance visa for immigration to the Kingdom of Spain, the following are required: a document confirming at least one year of remote work experience, financial guarantees, a certificate proving the applicant does not hold European citizenship, and written permission to work on projects online (from the employer company). Additionally, the applicant must prove the absence of a criminal record.

To obtain a residence permit in Spain, a remote worker must have health insurance and a certificate of contributions to social funds. If the employer is registered in the EU, the compatriot will need to provide a document from the Russian Social Insurance Fund. However, the problem is that the Kingdom’s authorities do not recognize either the account statement or the SNILS as proof of social contributions. As part of an additional request, the Spanish immigration office requires the Russian Social Insurance Fund to issue a document certifying the application of the norms of the interstate agreement on pension provision (between Russia and Spain) when the freelancer intends to work in the Kingdom. This bureaucratic hassle extends the review period for a digital nomad’s application.

Upon arrival in the country, the remote worker needs to improve their ability to speak the local language. A B1 level may not be enough to establish communicative connections with the locals. It doesn’t matter if there are many mistakes in the spoken language at the initial stage. Over time, language proficiency will be honed to such an extent that the local population will stop perceiving the relocator as a “tourist” and will see them as “a good guy who has been living here for so many years.”

In an attempt to speed up the process of integrating into the foreign labor market, a freelancer will benefit from analyzing benchmarks – the state of affairs in the professional field (IT industry, real estate, investments, etc.). If a remote worker wants to minimize the risk of receiving unjustified remuneration for services rendered, they need to invest time in studying offers from potential employers and analyzing salary information on professional internet resources.

Additionally, a freelancer should be prepared for the possibility of not finding mutual understanding with compatriots who have come to the country for tourism or are resolving emigration issues on alternative grounds. The former will be surprised that the remote worker can stay indoors for days when there is an opportunity to relax on local beaches. The latter are often outraged by another circumstance: why they have to go through strict bureaucratic barriers to obtain a residence permit when digital nomads face much fewer requirements.