As of December 2023, Portugal ranks sixth among the best countries for freelancers to live and work.

The Digital Nomad Visa program in Portugal, operational since October 2022, allows digital nomads to apply for a residence permit in the country. Residents of non-EU countries can apply for the freelancer residence permit.

The Portuguese Digital Nomad Visa is a type D state visa. After obtaining such a visa, a freelancer receives a residence permit valid for up to two years, with the possibility of further extension.

Specifics of Portugal’s Freelance Visa

Remote workers can apply for one of the forms of Digital Nomad Visa:

- Long-term. Valid for 4 months. Allows for a two-year residence permit with the requirement of continuous residence.

- Temporary. Valid for 1 year. Allows for multiple exits from the country. Does not grant the right to a residence permit.

Obtaining a freelancer visa involves confirming a monthly income of at least 3280 euros, as well as owning or renting property in the country. The applicant must be of legal age and have a contract for remote or freelance work with a local employer.

Relatives of remote workers (children under 18 and parents over 65) can also apply for a visa for temporary stay or residence. It is permissible to include children aged 18-30, if they are unmarried and financially dependent on the applicant parent.

Taxes for Freelancers

The type of digital nomad visa received is not a criterion for the formation of tax obligations. Taxes depend on the status of the tax resident. A foreigner is assigned the status of a “Portuguese tax resident” with permanent residence for more than 183 days per year. Depending on the status of a freelancer (self-employed or sole proprietor), the rate varies in the range of 14-48%.

By settling in Portugal, a freelancer can obtain the status of a non–permanent resident – NHR (non-habitual resident). This gives him several advantages at once:

- Digital nomad is not required to pay taxes on income from abroad;

- A foreigner is obliged to pay personal income tax on income earned in Portugal – 20% (against the standard income tax of up to 48%);

- Taxes to the pension fund are 10%, which is also significantly lower than the usual tax.

Currently, a digital nomad can only avoid paying tax on income earned abroad if he stays in Portugal for less than 183 days a year (less than six months). But at the same time, he loses the opportunity to apply for permanent residence and citizenship.

Tax table for digital nomads, freelancers, self-employed and sole proprietors

| Tax name | The amount of tax | Note |

| Income Tax (IRS) | 14,5%-48% ( progressive scale) | For tax residents (stay more than 183 days).

Bids: |

| IFICI+preferential mode | 20% | For highly qualified specialists in science, technology, medicine and education. Income under this regime is not included in the calculation of social contributions. |

| Social contributions (Seguranza Social) | 21.4% of 70% of income | Mandatory for registered freelancers (Trabalhador Independente). The first year – 0%, the second – 50% of the rate, the third – 75%, from the fourth – 100%. A voluntary 25% reduction is available with limited insurance coverage. |

| Value Added Tax (IVA) | 23% (standard) 13%, 6% (preferential) |

Required for annual turnover of more than €13,500. VAT is not applied for services to foreign clients outside the EU. Freelancers in the simplified mode (regime simplificado) are exempt. |

| Municipal allowances to the IRS | Up to 1.5% | Depends on the municipality. For example, in Lisbon – 1.5%, in the Azores – 0%. |

| Tax on dividends | 28% | Applies to income from equity participation. Benefits under double taxation avoidance agreements are possible for residents. |

| Corporate Tax (IRC) | 17% (up to 50,000€) 21% (50,001–200,000€) 25% ( more than 200,000€) |

For legal entities (LLC, SA). It does not apply to the self-employed and freelancers in simplified modes. |

Cost of the Visa

The cost of Portugal’s Digital Nomad is determined by the number of applicants and the type of real estate (rental or property). If you have your own home, you will also need to pay stamp duty (0.8% of the cost) and annual tax (0.3-0.8% of the cost).

Other expenses accompanying the process of obtaining a nomad visa will be the payment of life and health insurance (from 20 to 100 euros /month, depending on the package).

Below, for convenience, we have collected all the expenses for a digital nomad visa in 2025 in Portugal in one table.

| Fees, duties and other expenses for obtaining a visa | Cost |

| Savings in a bank account (if the submission takes place before the conclusion of a contract with a Portuguese company) | 9840 € per main applicant

+50% per spouse +25% per child |

| D visa fee | 90 € |

| Document translations | from 200 € |

| Real estate expenses | there are no requirements for the cost of the property or the amount of rent (the average cost of renting a house is 500-850 €) |

| Travel insurance when applying for a visa | from 14 € per month |

| Medical insurance for obtaining a residence permit in Portugal | from 20 € |

| Fee for processing an application for the production of a residence permit card | 85,05 € |

| Production of a residence permit card | 73,10 € |

| Full support of visa processing | from 4700 € |

| Residence permit for financially independent | from 5700 € |

| Student residence permit | from 1450 € |

| Residence permit through business registration in Portugal | from 2500 € |

Necessary Documents and Requirements

The requirements for documents to obtain a digital nomad visa include:

- Valid passport.

- Two photographs (size 4.5×3.5).

- Bank statement confirming a minimum monthly income and balance of no less than 36,480 euros.

- Proof of remote work – employment contract or partnership agreement.

- Letter explaining the reasons for coming.

- Valid medical insurance.

- Translated police clearance certificate to confirm no criminal record.

- Rental contract or property ownership certificate in Portugal.

- Documents proving family relationships (if relocating with family members).

Recent Changes in Visa Matters in Portugal

A major change in civil legislation, significantly affecting remote workers residing in the country, was the cancellation of tax incentives effective from 01.01.2024. The Portuguese government has excluded freelancers from the NHR program. The program has ended, and remote workers no longer have the right to tax benefits (0% on foreign income and 20% on local income for 10 years).

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

However, individuals already participating in the NHR program will not lose their tax benefits. Additionally, applicants who can prove that they began planning their move (for example, by applying for a freelancer visa) before 01.01.2024 can still receive these favorable tax rates.

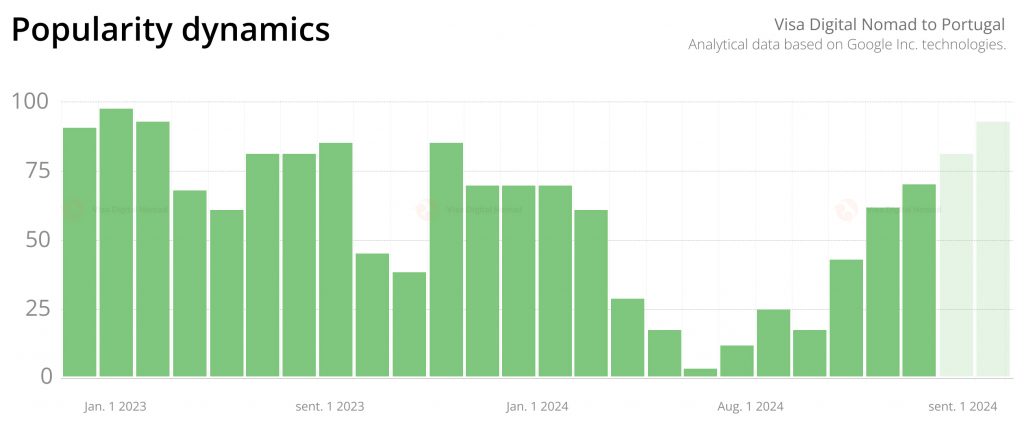

Freelancers planning to move to Portugal now will not have the benefit of the NHR program and will be subject to standard tax rates. Because of this, demand for the program sank by June 2024, according to Google Trends. However, despite the lack of tax advantages, by the beginning of July interest in a visa to Portugal began to grow again.

Frequently Asked Questions

The standard time for reviewing an application at the Portuguese Consulate is up to 60 working days (about 3 months). In some cases, especially when the workload of diplomatic missions is high, the process can take up to 4 months. To speed up the procedure, it is recommended to submit documents through accredited visa centers, where the time is reduced to 45 days.

Accelerated processing of applications under the Tech Visa program is available for IT specialists and employees of international corporations. The period for issuing a visa is reduced to 30 days, and a residence permit is issued in 2 months. The prerequisite is an employment contract with a Portuguese technopark resident company or participation in government startup programs.

An alternative visa for a period of 1 year allows you to stay in Portugal without obtaining a residence permit. Such a document is issued in 20 working days, but requires proof of income 1.5 times higher than the standard – from 5,220 euros per month. An extension is possible only once, with an increase of up to 18 months.

The legislation requires entry into the country no later than 90 days from the date of visa approval. Missing this period cancels the right to obtain a residence permit. There is an exception for family applicants: family members can enter later than the main applicant, but for no more than 30 days.

An application for a residence permit must be submitted to SEF within 30 business days from the date of first entry. In practice, due to the workload of migration services, it is recommended to start the procedure immediately after arrival. Registration for the submission of documents is carried out through the online platform SEF Portal. The average waiting time is 2-3 weeks.

Yes, individual documents must be apostilled and translated into Portuguese with a notarized certificate. It is mandatory to apostille a certificate of absence of a criminal record, educational documents, and certificates confirming kinship (when submitted with family members). In addition, a notarized translation into Portuguese of tax returns and documents confirming qualifications is required.

In addition to the monthly income, the applicant must confirm the existence of savings in the amount of at least 10,440 € (12 minimum wages in Portugal). This amount must be available in a bank account. To confirm, you must provide a bank statement for the last 6 months. When applying to the consulate, you can provide an extract from any bank that works with the SEPA payment system. In the future, when obtaining a residence permit, the funds must be transferred to a Portuguese bank account.

When family members are included in the application, the income requirements of the applicant remain unchanged (3,480€). Savings requirements are increasing. +50% (5,220€) for each adult family member and +30% (3,132€) for each child. It is necessary to provide documents confirming the relationship with an apostille. For children over the age of 18, proof of their financial dependence on the applicant is required. Each family member fills out a separate application and makes an appointment at the consulate for an accompanying visa.

Adding each family member increases the total processing time by 15-20 business days. For spouses and children over the age of 18, an additional financial security check is required, which adds 10-12 days to the standard review period.

In addition to a monthly income of € 3,480, the applicant must confirm the presence of € 10,440 in the account (12 minimum wages). For a family, the requirements increase: +5,220€ per adult (spouse, parent), +3,132€ per child. Bank statements must cover the last 6 months. When applying for a residence permit, funds must be transferred to a Portuguese bank account, which may incur fees for international transfers.

The applicant must rent or purchase a residential property in Portugal. In the case of a lease, the contract must be concluded for at least 3 months in order to obtain a short-term visa. At least for 1 year to increase the chances of a positive decision by the consulate when obtaining a long-term visa.

The lease agreement or ownership documents must be executed in the name of the applicant. To conclude a lease or purchase agreement for real estate, you must first obtain an individual taxpayer identification number (NIF).

The motivation letter is written in English or Portuguese and should include information about professional activities and work experience, the reasons for choosing Portugal to live in, plans for the period of stay in the country, a description of work as a digital nomad, and an explanation of how skills and experience can be useful in the country. The letter should be logical, structured and demonstrate serious intentions regarding the stay.

Medical insurance must meet the following requirements. The coverage amount is at least 30,000€ with a validity period for the entire period of stay. Action throughout Portugal with emergency medical care coverage.

To confirm your tax status, you must provide a tax return from your country of current residence, a certificate from your employer on taxes paid (if applicable), a document confirming your tax residence, and the tax number of your country of residence (with a Portuguese translation). These documents must confirm that the applicant regularly pays taxes in his country of residence. For more information about the Portuguese tax system, please read our blog article.

In Lisbon, renting a studio apartment costs 700-1,900€ per month. In The Port – 650-1,400 €. In Lagos – from 600€. The rental agreement must be concluded for at least 4 months for a temporary visa and for 1 year for a long-term one.

Apostillation of documents – the cost depends on the country of origin. Notarized translation into Portuguese – ~30-50€ per page. Opening an account in a Portuguese bank – the fees range from 50 to 200€ per year. Language proficiency exam – ~120€.

The application for an extension must be submitted 3 months before the expiration of the current residence permit. In case of delay, penalties are applied in the amount of 5-15% of the minimum wage for each day of delay. Upon timely submission of documents, a temporary residence permit (Autorização de Permanência) is provided, valid until the end of the verification of the request.

Proactive entrepreneurs may want to consider the Portugal Startup program, which provides a residence permit for 2 years at a time.

Government fees are non-refundable. Agency services often include a partial refund (50-70%) in case of refusal for reasons beyond the applicant’s control (for example, errors by the consulate). However, if the refusal is related to false documents, the funds are usually not compensated.

The right to apply for citizenship arises after 5 years from the date of obtaining the first residence permit. This period includes the validity period of both the D8 visa and subsequent residence permits. The naturalization process takes 12-18 months, with the applicant having to prove his knowledge of Portuguese at A2 level.