Germany is one of the leading EU countries, but it is not the most attractive location for freelancers looking to work remotely. Nearly the entire economy of the German state is based on traditional industrial sector enterprises, and the development of startups is still proceeding at a slow pace.

For the self-employed in Germany, a special type of visa is available that allows remote work and the provision of services privately (Freelancer-Visum). This visa is conditionally classified into two categories – one issued to sole proprietors (Gewerbetreibender) and the other to freelancers (Freiberufler).

A clear advantage for applicants for the freelancer visa is the absence of criteria regarding the size of financial security. However, the digital nomad must have funds to pay for housing and meet basic needs.

German authorities primarily approve the possibility of freelancing for candidates who can prove that their projects can positively impact the national economy and culture. Also, the potential participant in the digital nomad program will have to convince German officials of the viability of their business idea and its attractiveness to the labor market.

Permission to cross the border of the German state is granted to the self-employed by the Consular Section of the German Embassy (Moscow, Leninsky Prospekt, 95A (entrance from Akademika Pilyugina Street)).

Freelance Visa Specifics

Initially, a freelancer needs an Einreise-Visum, which is valid for several months, to enter the country. After crossing the national border, the nomad must notify German officials that he has arrived in Germany to engage in freelancing (or to develop startups).

In the department dealing with migration policy, it is necessary to obtain a document confirming the freelancer’s residence permit. Formally, it is considered equivalent to the digital nomad visa. The visa is issued in several types – for entrepreneurs (Gewerbetreibender) and freelance workers (Freiberufler), including artists, writers, architects, auditors, translators, tutors, and other representatives of liberal professions.

For Russians aspiring to participate in the digital nomad program, certain requirements are set, which include:

- The professional activity must meet regional needs and be of interest to the national economy;

- The client base must include at least 2 service users registered in Germany.

Despite the formal absence of financial security conditions, they are still imposed on applicants aged “45+” who are required to present a retirement savings plan. By the time of retirement (in Germany – 67 years), the pension amount of the self-employed must at least amount to 1,332 euros. If it is not possible to save this amount for social payments, financial security can be proven by property assets amounting to 195,000 euros (bank deposit, securities, real estate).

Freelancer Taxes

For nomad visa holders, as well as for all residents, a progressive tax scale is provided, the range of which varies from 0 to 45%. If the annual income of the self-employed does not exceed 9700 euros, then he is exempt from having to pay tax. With income from 9700 to 57,900 euros per year, the income tax rate is 14%. The higher the income, the larger the personal income tax.

Value-added tax is charged considering the specifics of the professional activity and the profit size at the initial stage of entrepreneurial activity. For instance, doctors and tutors do not pay VAT. If in the first year the self-employed’s income did not exceed 20,000 euros, and in the second year – 50,000 euros, then his business activity will be categorized as “small business,” and VAT will not be charged.

Tax table for digital nomads, freelancers, self-employed and sole proprietors

| Tax name | The amount of tax | Note |

| Income tax (Einkommensteuer) | 14-45% (progressive scale) | For tax residents (stay more than 183 days). Bids: before 10,908€ – 0%, 10,909–62,809€ – 14-42%, over 62,809€ – 45%. Non-residents pay tax only on income from German sources. |

| Value added tax (Umsatzsteuer) | 19% (standard) 7% (discounted for individual services) |

Required for annual turnover starting from €22,000. For small businesses (Kleinunternehmerregelung) with a turnover of 22,000€/year, VAT is not charged. |

| Social contributions (Sozialversicherung) | ~18-21% of revenue | Includes pension (18.6%), medical (14.6%) and unemployment insurance (2.4%). For the self-employed (Freiberufler), they are mandatory with an income of 5,700€/year. Benefits: the first year – 60€/month, the second – 141€/month |

| Solidarity contribution (Solidaritätszuschlag) | 5.5% of the income tax amount | Charged in addition to Einkommensteuer. Not applicable for annual income less than €16,956. |

| Trade Tax (Gewerbesteuer) | 3,5–15% from the profit | For sole proprietors (Gewerbetreibender) with an income of €24,500/year. The rate varies depending on the municipality. |

| Tax on dividends | 25% (+ solidarity fee) | Applies to income from equity participation in companies. |

| Municipal fees | 0,3–2% from the cadastral value of real estate | For home or office owners. For example, in Berlin it is 1.5%. |

Visa Cost

The consular fee for processing the nomad visa is 75 euros. Services of the visa center additionally cost 23.5 euros (service fee). For children under 6 years and persons with disabilities (+ accompanying person), a service fee of 4.7 euros is provided.

In the table below, we have written what expenses will be incurred when applying for a freelancer‘s residence permit in Germany.

| Fees, duties and other expenses for obtaining a visa | Cost |

| D visa fee for adult applicants | 75 € |

| The fee for issuing a D visa for minors | 37,50 € |

| The fee for issuing a residence permit | from 100 € |

| Fee for registration of a legal entity | 300 € |

| Rental housing | from 800 € |

| Full support of visa processing | from 1650 € |

| Student residence permit | from 1890 € |

Additionally, you need to take into account the cost of air travel to Germany from your place of stay, as well as the cost of translating documents and affixing an apostille stamp.

Required Documents

To apply for a Freelancer-Visum, the applicant will need:

- Application form;

- National ID passport;

- International passport;

- Document proving financial security (bank statement with a deposit of at least 12,000 euros or a profit and loss report with a minimum profit of 2,500 euros per month);

- Color photo 3.5 x 4.5 cm (2 copies);

- Receipt confirming payment of the duty;

- Recommendation letters from previous employers;

- License for professional activity (if necessary);

- Document proving the existence of clients/employers;

- Diploma;

- Future business project plan;

- Portfolio;

- Health insurance policy (with minimum coverage of 30,000 euros);

- Retirement plan (for applicants aged “45+”).

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Recent Changes in Visa Issues with Germany

Due to a severe shortage of skilled workers, the German authorities are interested in attracting foreign specialists providing services privately.

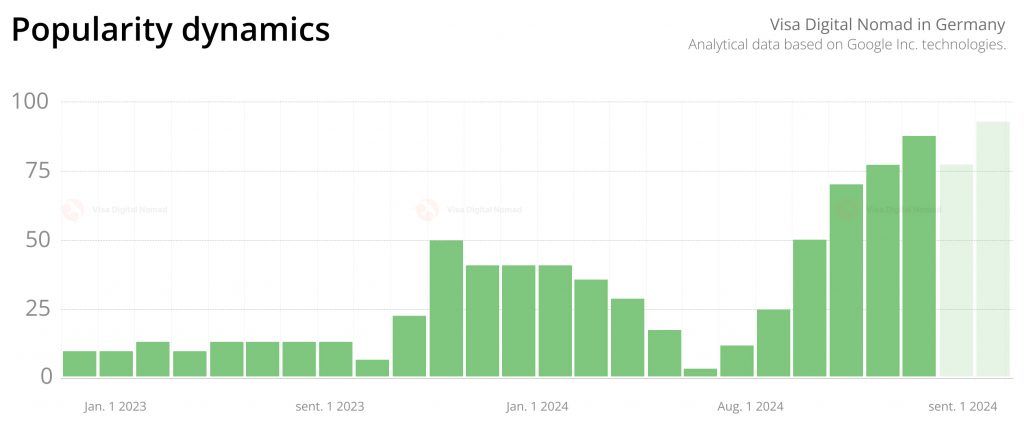

As of March 2024, the number of requests from Russians wishing to apply for Freelancer-Visum decreased slightly, but already at the end of July of this year, an active increase in requests on Google began to be observed.

Frequently Asked Questions

Yes, all documents except passports and insurance must be translated into German and officially certified, for example, by a sworn translator in Germany. This is a mandatory requirement that is strictly checked when reviewing the application.

It is required to provide at least 2-3 commitment letters from potential clients from Germany. In these letters, clients should indicate why they cooperate or plan to cooperate with you, what services you will provide to them, and confirm their interest in long-term cooperation.

To confirm financial viability, you must provide a bank statement with a sufficient amount for living, a completed financial viability form, documents on previous income (contracts, payment statements), and a completed form on future earnings forecasts.

A pension plan is mandatory for applicants over the age of 45. It must confirm that you have sufficient savings or insurance that will provide for you in old age. The document must confirm that you will not become a financial burden to the German social system.

The pension plan must cover a period of at least 5 years. The document is checked annually when extending the residence permit. If the savings decrease below the established minimum (10,350euros for 2025), the agency may refuse to extend it.

If you are applying as a self-employed entrepreneur (Selbständiger), you must provide a detailed business plan, information about the company’s profile, a business concept document, a detailed form on future costs and projected revenues, and confirmation that the activity will have a positive impact on the German economy.

Documents on financial viability, a form on future earnings forecasts, letters of recommendation, portfolios, letters from clients are required for a Freiberufler visa (liberal professions).

A Selbständiger (commercial entrepreneur) visa additionally requires a business plan, a company profile form, a business concept form, and detailed information about future costs.

To confirm your qualifications, you must provide a diploma of education (preferably recognized in Germany), certificates of additional education, licenses or permits for regulated professions (if applicable), a detailed portfolio with job examples, letters of recommendation from previous employers or clients.

Proof of sufficient medical insurance must be provided. At the stage of submitting documents to the consulate, medical insurance for travel (Reise-Krankenversicherung) is suitable. After arriving in Germany, in order to obtain a residence permit, you will need to purchase full-fledged German medical insurance from one of the official insurance companies.

Upon arrival in Germany, to obtain a residence permit, you will need a rental agreement, proof of residence registration (Anmeldung) from the local Burgeramt, confirmation of registration with the tax office (Finanzamt), documents on opening a bank account with a German bank, German medical insurance, payment for issuing a resident card (about 100 €).

The standard period for processing an application at the consulate is from 4 to 10 weeks. Delays are possible due to seasonal workload or the need for additional qualification checks. For example, diplomas that are not included in the ANABIN database (a database containing information on the assessment of foreign educational diplomas) require separate confirmation through the ZAB (certificate of assessment of a foreign diploma), which increases the time by 2-4 weeks.

The national Type D visa is valid for 3 months, during which registration procedures must be completed. This period is intended for submitting documents to the local Office for Foreigners (Ausländerbehörde) and obtaining a resident card.

After submitting the documents to the Ausländerbehörde, the resident’s card is produced in 2-4 weeks. However, it can take up to a month to make an appointment at the department due to queues, especially in large cities.

The overall process takes from 3 to 6 months, including 4-10 weeks for visa review, 3 months for post-entry actions, 2-4 weeks for card production.

A primary residence permit for freelancers is issued for 1-3 years, depending on the completeness of the business plan (for Selbständiger), the number of confirmed clients in Germany, and the profession’s compliance with the list of “free” specialties.

The application is submitted 2-3 months before the expiration date. The review takes 4-8 weeks. For a successful extension, it is necessary to confirm a stable income and the absence of violations of tax legislation.

The procedure for opening an account with a German bank (for example, N26 or Commerzbank) lasts 3-7 business days if you have an Anmeldung questionnaire (registration at the place of residence), a valid residence permit, and proof of income.

The right to a permanent residence permit (Niederlassungserlaubnis) arises after 5 years, provided a stable income above the subsistence level (€1,200/month in 2025), successful integration (level B1 in German), and no criminal record.

The consular fee is 75€ for most applicants. Turkish citizens pay a reduced fee of € 28.80 for persons over 25 years of age. An additional fee is € 23.5–€47 for visa application center services, including biometrics processing. For Selbständiger (entrepreneurs), when submitting a business plan, they may need to pay 100€ for the examination of the document at the Chamber of Commerce and Industry.

At the stage of submitting documents, temporary travel insurance is sufficient (20-50 €/month). Full-fledged German insurance is required after the move. Techniker Krankenkasse (TK) – ~200 €/month for persons under 30 years of age. AOK – ~250 €/month with extended coverage. Persons over the age of 45 are recommended to pay an additional 50-100 €/month for pension savings programs.

Translations into German with the certification of a sworn translator cost 25-40 €/page. For a standard package (diploma, recommendations, lease agreements), the total amount reaches 300-500 €.

Freiberufler (liberal professions): the fee for the resident’s card is 100 €, the annual cost of renewal is 80-120€.

Selbständiger (entrepreneurs): business registration in Gewerbeamt – 20-60€; annual trade tax (Gewerbesteuer) – 3.5% of profits.

Registration of housing (Anmeldung) is free, but for urgent registration they charge 30€. Opening a bank account: N26 – free of charge, Commerzbank – € 5/month. Production of a resident’s card – 100 €. Tax consultation – 150-300 €/hour.

The minimum rental period for submitting documents is 6 months. In Berlin, prices start from 800 €/month for a studio, 1200 €/month for a 2-room apartment. The deposit is 2-3 monthly payments.

Re-examination of the business plan – 200-400 €, updating of the pension plan for persons 45+ – 100-150€, additional payment for accelerated review – 50€.