Hungary issues the digital nomad visa exclusively to citizens of third countries. It is sought by company employees who wish to work remotely, as well as sole proprietors registered in Russia or another country. It is obtained by businessmen managing affairs remotely and earning income from business/assets outside the country.

Budapest attracts IT developers and specialists related to digital technologies. Marketers, designers, and engineers with an income of €2,000 per month come here. The main requirements for employees are having an employment contract and proof of high income for the last six months.

Digital nomads can:

- Live and work in an inexpensive European Union country;

- Cross the borders of Schengen states;

- Open bank accounts based on a rental agreement, work contract with different service rates;

- Pay a relatively low income tax by EU standards.

However, for the self-employed and freelancers, there are restrictions. The Digital Nomad Visa does not grant the right to work in a local company or the chance to become a permanent resident. Obtaining permanent residency is possible under the condition of applying for a national type of visa on another basis. Moreover, two years lived under a White Card do not count towards migration experience.

How much does a White Card cost?

Processing involves expenses for administrative fees. When submitting an application form in the country of residence, the service cost in 2024 is €126. In Hungary, it is renewed for €112. When processed through the NDGAP online portal, the price does not exceed €77. When obtaining a residence permit at the immigration police, a fee of €110 is charged.

Additionally, “nomads” pay €50 for document translation into English and at least €15 for medical insurance. In case of a visa refusal, applicants file an appeal at the immigration office or the Hungarian consulate, paying €160. Consular payments by Russians are made exclusively through a bank card.

For convenience, the cost of each spending section is shown in the table below.

| Fees, duties and other expenses for obtaining a visa | Cost |

| State duty | 126 € |

| Medical insurance | from 15 € per month |

| Rental of real estate for the entire period of residence permit | from 800 € per month |

| A one-time deposit for the property at the beginning of the lease | the amount of the monthly payment |

| Document translations | from 50 € |

| Full support when applying for a visa | from 1900 € |

| Hungarian residence permit through business registration | from 3750 € |

Additionally, you need to take into account the cost of air travel to Hungary from your place of stay.

What taxes do freelancers pay?

After 183 days, nomads residing in the country continuously receive identification numbers and become tax residents. The tax rate for all individuals is 15%. Self-employed individuals and sole proprietors pay percentages of their profits into the insurance fund and contribute 2% towards social and municipal taxes and business.

They choose their tax regime from fixed rates:

- Basic – 57.5% of profits;

- Simplified – 4.85% to 29% of revenue;

- Simplified KATA with a fixed amount – €130.59.

The latter regime is designed for people engaged only in entrepreneurship, earning annually €47,011.68, selling goods and services to people. You can find out more about taxation, register as a taxpayer and receive other services on the website of the Hungarian National Tax and Customs Administration.

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Tax table for digital nomads, freelancers, self-employed and sole proprietors

| Tax name | The amount of tax | Note |

| Income Tax (SZJA) | 15% (for individuals) 9% (for legal entities) |

For tax residents (stay more than 183 days). Digital nomads with a White Card visa are exempt from tax on foreign income. For sole proprietors and freelancers, it applies to income from Hungarian clients. |

| Social contributions (TB) | 18.5% (employee) + 13% (employer) | Mandatory for registered freelancers and sole proprietors. The minimum base is 35% of the average salary (≈300€/month). White Cards are not charged for participants of the program if the income is earned outside Hungary. |

| Value added tax (VAT) | 27% (standard) 5%, 18% (preferential) |

Required with an annual turnover of more than 12 million HUF (≈33,000€). 0% is applied for the export of services and digital nomads working with non-residents. |

| KATA preferential treatment | 50,000 HUF/month (≈136€) | Is available for the self-employed with an income of 3 million HUF/client per year and a total turnover of 12 million HUF/year. If the limit is exceeded, an additional tax is charged – 40% of the excess amount. |

| Corporate Tax (TAO) | 9% | For legal entities (LLC – Kft). It is applied to the net profit. For sole proprietors registered as Kft, optimization is possible through the payment of dividends (15%). |

| Municipal tax | Up to 2% of revenue | Is charged by local authorities depending on the municipality. For example, in Budapest – 2%. |

| Tax on dividends | 15% | Applies to income from equity participation in companies. For residents of Hungary, there are benefits under agreements on avoidance of double taxation. |

Required Documents and Requirements

The list is published on the embassy’s website. It includes:

- Application and Appendix 16 in English;

- International passport valid for one year;

- Biometric photos 3.5 × 4.5 cm;

- Permission to work specifying the position, experience, salary;

- Certificate of the actual activity of the company;

- Proof of income of €2,000 over six months from an account statement.

- Businessmen and shareholders indicate the registration numbers of companies, shares, and present certificates from the tax office. Candidates must also attach medical insurance. Freelancers can buy a full service package or a reduced package for €100 for emergencies at Generali or Teladoc.

After application approval, the candidate receives a visa for single entry and obtains a White Card within a month at the local immigration department. The process of reviewing and obtaining a freelancer’s residence permit from the moment of document submission takes up to 4 months.

Recent Changes in Visa Matters in Hungary

In 2024, a law for immigrants from third countries is in effect with new entry and residence requirements under a type D visa. It concerns self-employed foreigners (Appendix 9.2.), conditions for obtaining a White Card (Appendix 9.18.), permits for staying in the country for job searching, internships, and business purposes.

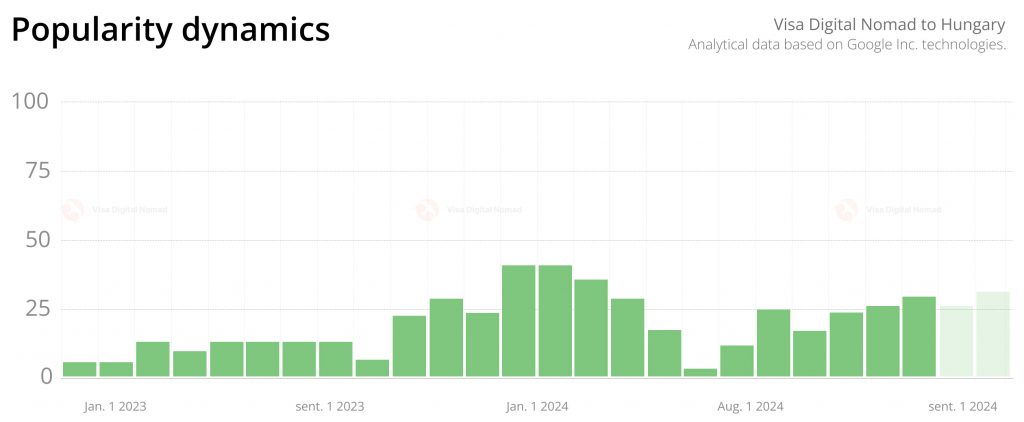

According to the general trend with other countries providing programs for freelancers, the demand for a digital nomad visa decreased by the end of the 2nd quarter of 2024, and skyrocketed by the beginning of the third. Such information is available thanks to open data Google Trends.

Frequently Asked Questions

The initial residence permit is issued for 12 months with the possibility of a one-time extension for another 1 year. The total maximum period of stay under this program is limited to 2 years, after which it is required to leave the country for at least 90 days before reapplying.

After a positive decision, the applicant receives a 30-day entry visa of category D, during which it is necessary to cross the Hungarian border. Missing this deadline leads to the cancellation of the permit and the need to resubmit the documents.

Upon arrival in Hungary, a foreigner has 30 days to apply to the district office of the National Directorate for Foreigners (NDGAP). The residence permit card is produced within 14-21 business days and is issued in person or sent by mail to the place of registration.

The application for renewal is possible no earlier than 60 days and no later than 15 days before the expiration of the current residence permit. The procedure takes up to 30 working days, and the applicant must confirm that he has fulfilled the condition of staying in the country for at least 90 days in the last 180 days.

To confirm income, you can provide a bank statement for the last 6 months confirming a monthly income of at least 3,000euros, a valid employment contract with an indication of the corresponding salary, and a tax return (for individual entrepreneurs). More about the Hungarian tax system.

Bank statements and tax returns must be dated no later than 30 days at the time of application. Additionally, entrepreneurs need an up—to-date extract from the register of companies (valid for 3 months).

Hungarian migration legislation does not allow a digital nomad to relocate with family members. However, family members can apply for a visa on other grounds (study, work, vacation), or if the spouse also works remotely and earns from the required amount per month, they have the right to apply for a visa on the same grounds.

A foreign passport must be valid for at least 1 year after the date of application.

Yes, all documents must be translated into English or Hungarian and notarized. This is a mandatory requirement for the Hungarian migration services to review the application.

Medical insurance must have a minimum coverage of 30,000euros per person, be valid for the entire period of stay in Hungary, and include international coverage.

To confirm your residence address in Hungary, you must provide a rental agreement for the entire duration of your residence permit (for at least 12 months) or a purchase and sale agreement for real estate in Hungary (if you have purchased a home).

The rental or booking agreement must cover the full term of the requested residence permit. Upon first request, a 3-month preliminary contract is accepted with an obligation to provide a full contract within 60 days of arrival.

Documents must be submitted in person at the Hungarian Consulate in the country of residence. Biometric data is provided when submitting documents. If the documents are submitted in Hungary, you must attach an explanatory note about the reasons for the foreigner’s stay in the country.

The standard time for reviewing an application is from 21 to 30 business days. However, the full period of visa processing from the beginning of the collection of documents to the receipt of the “white card” may take 3-4 months.

The costs of obtaining a digital nomad visa include an application fee (110€), translation of documents into English or Hungarian (from 50€), rental of real estate for a year (from 800€ per month or from 9,600€ per year), deposit for rental of real estate (in the amount of a monthly payment, from 800€), medical insurance (from € 15 per month).

State fees are differentiated when applying abroad (110€), through the online NDGAP portal (77€), upon extension: (58€), appeal upon refusal (160€).

The rental deposit is fully refunded if the refusal is received prior to entry. Government fees are non-refundable, except in cases of technical errors on the part of the migration service. Insurance premiums are compensated in proportion to the unused period.

No, obtaining Hungarian citizenship through a digital nomad visa is not possible. A “white Card” is a temporary residence permit that is granted for up to 2 years (one year with the possibility of extension for another 1 year) and does not lead to permanent residence or citizenship.

The period of residence in the country under this visa is not counted for naturalization, which requires a long stay in Hungary based on other types of residency. After the expiration of the validity period of the “White Card”, the applicant is obliged to leave the country, but can apply for another type of residence if it meets its requirements.