In April 2024, Italy officially introduced the opportunity to obtain a digital nomad visa. This is a full-fledged permit to reside in the country for one year, with the possibility to be absent from the country for up to half of this period. The program is designed for citizens of non-EU countries.

The main innovation of this visa is the absence of the need to request a residence permit in Italy. Applicants apply directly at the consulate. A residence permit is granted for one year and can be extended if conditions are met.

Specifics of the Freelance Visa in Italy

It is important to remember that for the first five years of stay in the country, freelancers are only allowed to work remotely. Official employment in Italy is not available.

After five years of living in Italy, it is possible to apply for a permanent European residence permit for long-term residency. This residence permit has no restrictions or endorsements. And after ten years of living in the country, one can apply for citizenship.

Taxes for Holders of Italy’s Digital Nomad Visa

For the first five years, there is a preferential tax regime for employees or self-employed who have not previously lived in Italy. But the order of the numbers has not yet been clarified. The Italian government is discussing a possible simplified tax regime for digital nomads.

Therefore, it is best to rely on standard Italian tax rates:

- Incomes up to €28,000 are taxed at 23%.

- Incomes from €28,000 to €50,000 – 35%.

- Incomes over €50,000 – 43%.

- Mandatory health insurance costs about €2,000 per year.

Tax table in Italy for digital nomads, freelancers, self-employed and sole proprietors.

| Tax name | The amount of tax | Note |

| Income Tax (IRPEF) – General regime | 23%-43% ( progressive scale) | Applies to tax residents (stay >183 days). Bids:

Deductions of expenses are possible. |

| Regional and municipal surcharges to IRPEF | Regional: 1.23%-3.33% Municipal: 0%-0.8% |

Are charged in addition to the national IRPEF under the general taxation regime. The rate depends on the region and municipality of residence. |

| Income Tax (IRPEF) – Preferential treatment (Forfettario) | 5% (first 5 years) 15% (from year 6) |

For freelancers/Sole proprietors with an income of up to € 85,000 (the threshold may vary). The tax is calculated based on % of income (the coefficient depends on the type of activity, for example, 70% or 78%). Expenses cannot be deducted. Available to digital nomads. |

| Value added tax (VAT / IVA) | Standard: 22% Lowered: 4%, 5%, 10% |

Is mandatory for most sole proprietors and freelancers, registration of a VAT number (Partita IVA) is required. Persons in the Forfettario mode are exempt from VAT. The standard rate is 22%. |

| Social Contributions (INPS) | Depends on income and category (for example, Gestione Separata for freelancers) | Mandatory for freelancers and sole proprietors registered in Italy. For the Forfettario mode, a 35% discount on contributions is possible. |

| Production Tax (IRAP) | Usually 3.9% (may vary regionally) | Is charged to companies and sole proprietors/self-employed with a specific organizational structure. It often does not apply to individual freelancers and those on the Forfettario mode. |

How much does the freelance visa to Italy cost?

From direct expenses necessary for gathering a package of documents to obtain a nomad visa in Italy, a fee of €116 is required for the consular fee (the consular fee amount may vary by country). If you prefer not to handle the collection and submission of necessary documents on your own, there are companies that provide these services on a turnkey basis. Costs vary, as the service packages offered differ.

In the table below, you can see what expenses will be incurred when applying for a digital nomad visa to Italy.

| Fees, duties and other expenses for obtaining a visa | Cost |

| The fee | 112 € |

| Consular fee | 30 € |

| Medical insurance | from 350 € to 600 € |

| Marca da bollo | 16 € |

| Full support of visa processing | from 4500 € |

| Student residence permit | from 1890 € |

Additionally, you need to take into account the cost of a flight to Italy from your location, as well as the cost of translating documents.

Necessary Documents and Requirements

Mandatory documents required for submission to the consulate:

- Passport, copy and a photograph.

- Completed application form.

- Work contract.

- University degree.

- Income documents.

- Certificate of no criminal record.

- Health insurance.

- Payment of the consular fee – €116.

Additional Documents:

For obtaining legal residency status in Italy, you will also need:

- Documents proving an annual income of €25,000 (for family reunification – additional income of €8,500 per year).

- Obtain health insurance.

- Secure housing (may be rented, or prove the availability of funds for rent).

- Provide evidence of previous work experience and regular income.

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Recent Changes Regarding the Nomad Visa in Italy

In 2022, a bill introducing the digital nomad visa was approved in Italy. The authorities are actively trying to attract remote workers, as several other EU countries have successfully done for years.

The advantages of such visas for the state are clear. Italy will gain an influx of new highly skilled specialists, who will not only pay taxes but will also spend their earned money in the country. Meanwhile, this new flow of workers will not take jobs from the local population, as their employer is abroad.

This is beneficial for the economy and the development of certain regions of the Italian state. However, the current tax conditions cannot be called attractive. Nonetheless, there are several programs in Italy that allow for state support, including relocating to specific regions or purchasing property in certain cities.

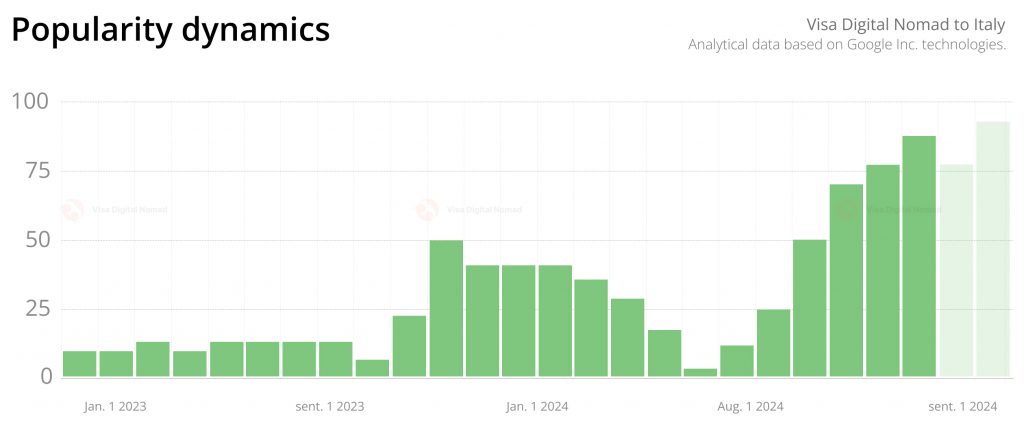

Due to the peculiarities of the Digital Nomad visa in Italy, according to open data from Google Trends, there is an abrupt dynamics of interest in the program, but the general dynamics over 2 years show a general increase in demand for it.

Frequently Asked Questions

Medical insurance must meet the following criteria: cover the entire period of stay in Italy; include coverage of all necessary medical expenses and hospitalization during your stay in the country; be valid at the time of submission of documents. The cost of compulsory medical insurance is about 2000€ per year.

To confirm the availability of suitable accommodation, you must provide a rental agreement or a confirmation of the hotel reservation for the initial period of stay.

To confirm the required work experience, documents confirming work experience of at least 6 months in the relevant field are required; letters of recommendation from previous employers or clients; a portfolio of works (especially for creative professions).

The processing time varies depending on the workload of the consulate and the region of application. The standard period is from 15 business days to 3 months.

The visa is issued for 365 days from the date of approval. However, the actual period of stay starts from the date of entry into Italy. It is important to note that the category D visa that applicants receive allows them to stay in the country until the moment of obtaining a residence permit (residence permit).

The law obliges digital nomads to contact the local police department within 8 days of crossing the border. The delay may result in fines or visa cancellation.

After submitting documents to the police department, the resident’s card (Permesso di soggiorno) is usually issued within 20 days. However, in regions with a high migration burden, the period may increase to 2-3 months.

The initial residence permit is valid for 12 months. An extension is possible while maintaining the conditions of the program: confirmed income, valid medical insurance and availability of housing. The application for an extension is submitted 60 days before the expiration of the current residence permit. The second resident card is usually issued for 2 years. After 5 years of residence, you can apply for permanent residence.

Family members included in the main applicant’s application receive a residence permit for the same period as the digital nomad. However, if the documents are submitted separately (for example, when reuniting after moving), the process may take an additional 30-45 days. The requirements for the submission period are identical — registration is no later than 8 days after entry into Italy.

The insurance must cover the entire period of validity of the visa — at least 12 months. If the applicant plans to extend the residence permit, it is recommended to immediately apply for a policy for 2-3 years.

Financial documents must be dated no later than 30 days at the time of application.

Basic expenses include: a consular fee of 116€; medical insurance ~2,000 €/year; translation services/legalization of documents 500-1,500€ (depending on the volume); registration of a residence permit of 100-200€. For family applicants, expenses increase: insurance for a spouse adds ~ 1,500 €, for each child – ~800€.

The cost varies depending on the region. North (Milan, Turin): 1,200-2,500 €/month for a 2-room apartment. The center (Rome, Florence): 900-1800 €/month. South (Sicily, Calabria): 600-1,200 €/month. As a rule, an advance payment for 3 months + a deposit of 2-3 monthly rent is required.

The application is submitted 60 days before the deadline. It is required to confirm the retention of income above the minimum threshold, the availability of valid health insurance, and the absence of offenses. Renewal fee: 200 € + 80 € per stamp (marca da bollo). The review takes 30-45 days.

Although language proficiency is optional, a CILS B1 certificate increases the chances of visa approval. Online courses 300-600€ (A2–B1 level). Face-to-face classes 800-1 200€/month. The exam fee is 120€.

Additional costs often include: notarization of powers of attorney 200-400 €; courier delivery of documents 50-150 €/dispatch; apostillation 30-80 €/document; medical commission 150 €. The total minimum cost of the first year of stay is 18,000–25,000€, including all mandatory payments and rental housing.

It is possible to obtain Italian citizenship through a digital nomad visa, but it is a long process. The Digital Nomad Visa provides a temporary residence permit (residence permit), which can be extended, and then serves as the basis for obtaining a permanent residence permit (permanent residence) and citizenship.

You can apply for citizenship after 10 years of legal residence in the country. This period includes 5 years of temporary residence permit and 5 years of permanent residence permit (permanent residence). At the same time, it is allowed to be absent from Italy for no more than 10 months during the last 5 years before submitting an application.