In 2024, the Government of Kazakhstan launched the Digital Nomad Residency program to provide special visas for digital nomads. Migration legislation classifies such a freelancer visa to category B9, which can be obtained by a foreigner with a profession in demand for the country.

Also, in order to obtain the right to join the program, the applicant must obtain medical insurance in Kazakhstan in the country.

Specifics of Kazakhstan’s Freelance Visa

Currently, for Russians (as well as other EAEU citizens), it is lawful to stay in the country for up to 90 days without a visa. For longer stays, digital nomads will need to apply for a freelancer residence permit. It is important to note that a full work permit in Kazakhstan is issued to a limited number of foreign nationals with quite stringent requirements for the applicant. Therefore, the process of obtaining a Kazakh work visa is quite complicated.

Taxes for Freelancers

Since a freelancer is not an employee of Kazakhstani companies, they must independently declare any income in accordance with Articles 321 and 338 of the Tax Code of the Republic of Kazakhstan. To do this, one needs to become a resident, obtain a tax identification number (TIN), and choose their tax status.

A country’s resident is required to pay taxes on worldwide income, while a non-resident only needs to pay taxes on income earned within the country. To obtain a TIN, one must apply to the “Government for Citizens” state corporation, and it takes just 1 working day.

A digital nomad can pay taxes as an individual (this option also suits the self-employed) or as a sole proprietor. The individual income is taxed at a rate of 10%. The tax period is 12 months. Freelancers must file their tax returns by March 31 of the year following the reporting year. If working as a sole proprietor, a digital nomad can choose from several tax regimes – general (rate of 10%) and special, including a patent regime (based on the cost of the chosen patent), simplified (payment of personal income tax, social taxes, and contributions), and a fixed deduction regime (up to 30% of income).

Tax table for digital nomads, freelancers, self-employed and sole proprietors

| Tax name | The amount of tax | Note |

| Single payment for the self-employed | 4% of revenue | Includes pension, social, and medical contributions. It is applied with an income of 1.25 million tenge/month (≈340 MCI). |

| Individual Income tax (IIT) | 10% | For residents (staying more than 183 days) with income from Kazakhstani sources. It does not apply to digital nomads with a Neo Nomad visa with foreign income. |

| Corporate Income Tax (CIT) | 20% | For legal entities (LLP). Freelancers can register an LLP in a simplified mode (3% with an income of 12 million tenge/year). |

| Value added tax (VAT) | 12% | Mandatory for sole proprietors and companies with a turnover of 30,000 MCI (≈8.5 million tenge/year). Does not apply to digital nomads with foreign income. |

| Social contributions (for sole proprietors) | 1,5–2,5% from income | Required when registering an individual entrepreneur. They include medical insurance. There are benefits for IT specialists at Astana Hub (0% if the conditions are met). |

| Withholding tax | 5–20% | For non-residents who receive income from Kazakhstani clients. The rate depends on the type of income (royalties – 15%, services – 20%, dividends – 15%). |

Cost of the Visa

Since there has been no official publication on the conditions for issuing the nomad visa, there is currently no precise information about the cost. Under current conditions, the cost of obtaining a work permit in Kazakhstan varies from $950 to $1,729 USD, depending on the foreigner’s category and the employer’s business.

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Necessary Documents and Requirements

Based on the information available, the following are the requirements for the package of documents to obtain a freelancer residence permit under the Digital Nomad program:

- Application form and completed questionnaire.

- Valid foreign passport with at least 6 months remaining at the date of travel and at least 2 blank pages.

- Proof of accommodation – rental contract or property purchase.

- International medical insurance covering the territory of Kazakhstan.

- A recent monthly bank statement from the applicant’s home country clearly stating the applicant’s name as the account holder, account balances, and the date of the statement. If the statement is printed online, it must be certified by a bank employee.

Recent Changes in Visa Matters

Amid several waves of immigration from Russia, the Ministry of Foreign Affairs of Kazakhstan initiated amendments to the legislation to provide special visas for IT specialists on favorable terms. Currently, the amendments have been approved by a working group and have received approvals from several competent state bodies with a positive conclusion from the Government of the Republic. The main goal of the amendments is to bring foreign specialists out of the grey area, legalizing their stay in Kazakhstan.

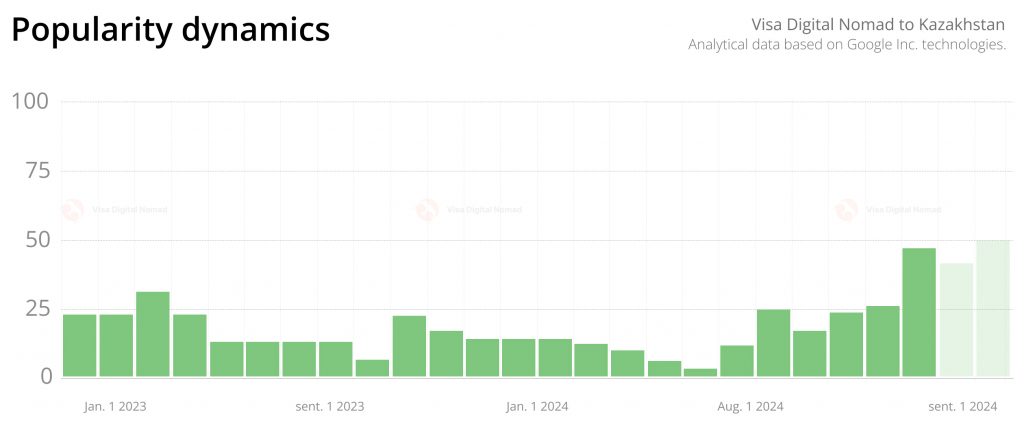

Thanks to the development of the digital nomad visa program in Kazakhstan, according to Google Trends, the demand for it in this country, although not prohibitively high, is stable.

Frequently Asked Questions

The minimum monthly income to be confirmed is $3,000. Income must be from sources outside the Republic of Kazakhstan.

You can confirm your income with a bank statement for the last 6 months, demonstrating a stable monthly income of at least $3,000, a tax return, an employment contract with a foreign company (to confirm the status of a remote employee).

The bank statement must reflect the last 6 months before submitting the application. The document is considered valid if it is dated no later than 1 month before contacting the consulate.

A certificate of absence of a criminal record must be issued by the authorized body of the applicant’s country of citizenship. Certificates issued no earlier than 3-6 months prior to submission are accepted for consideration. In some cases, it may be necessary to translate the certificate into Kazakh.

Medical insurance must cover the entire period of stay in Kazakhstan (up to 1 year). It must provide insurance coverage for receiving medical care throughout the Republic of Kazakhstan. The standard amount of nomad visa coverage is $30,000.

An invitation from a travel company (from the Astana Hub technopark or an authorized body of the Kazakh IT sector) in Kazakhstan is required by most applicants, but is not mandatory for citizens of 48 countries included in the list of economically developed, politically and migrationally stable states. Russian citizens need an invitation. The invitation is an official document issued by a licensed travel company of the Republic of Kazakhstan, confirming that the company invites the applicant to visit the country as a digital nomad.

The invitation must be valid at the time of application. The exact validity period of the invitation is not regulated, but it is recommended that it be issued no earlier than 1 month before contacting the consulate.

The procedure for obtaining a Neo Nomad Visa takes up to 5 business days. After checking the dossier by the migration service and making a positive decision, a visa is issued, allowing you to stay in Kazakhstan for up to 1 year.

Personal presence is required only at the stage of biometric registration at the consulate. Copies of documents may be submitted through accredited agencies.

Yes, family members and dependents of the main recipient of the visa can obtain a visa for the duration of the visa of the main applicant. The requirements for the amount of income do not change.

Family members of the main applicant (spouses, children, dependents) receive a visa at the same time as the main applicant or within 5 working days after submitting a separate application. The validity period of their visas coincides with the permission of the main applicant, but requires proof of kinship (marriage certificate, birth certificate).

The application must be submitted to the Embassy or Consulate of the Republic of Kazakhstan. For citizens of the EAEU countries (including Russia) who can stay in Kazakhstan without a visa for up to 90 days, it is possible to obtain a residence permit already inside the country.

The Neo Nomad visa is initially issued for up to 1 year with the right of multiple entry. An extension is possible for a similar period by submitting a request to the Ministry of Internal Affairs of the Republic of Kazakhstan. To extend the visa, you must confirm that the conditions under which the visa was issued have been preserved: stable income, valid medical insurance, and no violations of migration laws.

The visa extension procedure takes up to 5 business days. Similar to the initial design.

It is recommended to start the registration process 1-2 months before the planned date of entry. This is due to the need to collect documents and keep them up to date. It is also necessary to take into account the time to receive an invitation from the host party.

The Neo Nomad visa does not have a strict deadline for initial entry. However, it is worth using it within 90 days from the date of issue.

The main expenses include a visa fee (45€), medical insurance (from 200€ per year), translation of documents (15-30€ per page), travel company services (from 100€ per invitation).

Additional costs include apostilling a criminal record certificate (50-80€), courier services (20-50€), bank fees (10-20€).

The extension of the Neo Nomad visa requires the payment of a repeat visa fee of 45€. Additionally, you must provide updated health insurance and an income statement for the last 3 months.

The visa fee is non-refundable. The exception is the technical errors of the consulate (for example, incorrect filling of the receipt).

Obtaining Kazakh citizenship through a digital nomad Visa (Neo Nomad Visa) is not directly possible. To obtain a passport, you must complete the standard naturalization procedure, which includes long-term residence in the country based on a permanent residence permit (usually at least 5 years) and knowledge of the language.