In December 2021, following the COVID-19 pandemic, Romania became one of the European countries to introduce a visa program for digital nomads. As of early 2024, Romania ranks third among the best countries for freelancers.

The Romanian Digital Nomad program offers temporary residence permits for 12 months or more to remote workers from non-European countries as a means to stimulate local economic development.

Specifics of the Freelance Visa in Romania

The Romanian Digital Nomad Visa is available to foreigners who meet the following requirements:

- Citizenship of a non-EU/EEA country.

- Employment with a company registered and located outside Romania (self-employed status is also acceptable).

- Ability to perform all work duties remotely.

Additionally, the qualification requirements for the nomad visa include proof of an average income at least three times higher than the average salary in Romania (€3,300 per month) for each of the previous six months before applying.

The process involves two main steps: applying for a long-term visa (type D), which allows staying in the country for up to 90 days, followed by an application for a freelancer residence permit based on the Digital Nomad visa, which legally allows living and working in the country for 12 months with the possibility of extending for another 12 months. It is important for Russians to apply for the visa before entering Romania.

What Taxes Do Freelancers Pay?

Unlike Romanian citizens, digital nomads are not considered tax residents. Therefore, they are not subject to any Romanian taxes for the first six months. According to Law No. 69 dated March 29, 2023, after six months of legal residence in the country, nomads come under the general legislation for tax residents. In this case, they must pay 10% on worldwide income. Social contributions of 25% must also be paid.

Taxes for digital nomads, freelancers, the self-employed and sole proprietors

| Tax name | The amount of tax | Note |

| Income tax (for digital nomads) | 0% (first 6 months) 10% (after 183 days of residency) |

Digital nomads are exempt from taxes on foreign income in the first 6 months of their stay. After acquiring a tax residence (residence for more than 183 days), the standard rate of 10% on global income is applied. |

| Income tax (for freelancers/sole proprietors) | 10% | Uniform rate for tax residents. Applies to income from entrepreneurial activities, including self-employment. Deductions of expenses are possible for sole proprietors. |

| Simplified taxation regime | 1-3% of turnover | Available for sole proprietors with an annual turnover of more than 1 million euros. The tax replaces income and corporate taxes. It does not apply to digital nomads working for foreign clients. |

| Value added tax (VAT) | 19% (standard) 9%, 5% (preferential) |

Required for a turnover of more than 88,500 euros/year. 0% is applied for the export of services and digital nomads working with non-residents. |

| Social contributions | 25% (10% – employee, 15% – employer) | Mandatory for registered freelancers and sole proprietors. The minimum base is 35% of the average salary (≈300 euros/month). Benefits are possible for participants in the IT sector. |

| Corporate tax | 16% | For legal entities (SRL is the equivalent of LLC). It does not apply to the self-employed and freelancers in simplified modes. |

Cost of the Visa?

Applications for the Digital Nomad Visa should be submitted no earlier than 90 days before the planned trip and no later than 14 days prior. The cost is €120. Upon arrival in the country, the freelancer must obtain a temporary residence permit, which also costs €120.

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Necessary Documents and Requirements

When applying for a freelancer visa, the following documents are required:

- Application form for the residence permit.

- Valid passport (original and copy).

- Proof of accommodation in the country – property purchase or rental agreement.

- Evidence of meeting minimum income requirements.

- Employment contract.

- Medical certificate of health.

- Proof of fee payment for the residence permit application.

After submitting the application, the processing time is 10-14 days. Progress can be checked in your eVisa platform account.

Recent Changes in Visa Matters

Following legislative changes in 2021 regarding long-term visas for digital nomads, an important change was the publication by the Romanian tax authorities of Law No. 69/2023, which directly regulates the taxation process. According to this law, foreigners who come to Romania to work remotely for foreign companies using information and communication technologies are exempt from the requirement to pay income tax and social insurance contributions on wages and incomes earned abroad.

Tax benefits are valid only if the digital nomad stays in Romania for no more than 183 days (either in one period or several cumulative periods) during any consecutive 12-month period ending in a given calendar year.

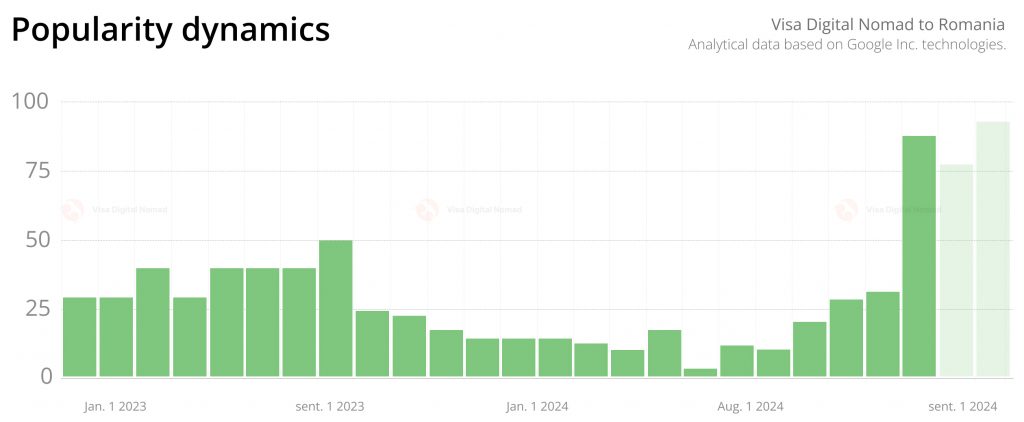

Recent news about tax incentives has had a positive impact on interest in Romania’s digital nomad visa. The graph compiled using open data from Google Trends and Yandex.Wordstat shows that by the beginning of the fourth quarter of 2024, demand for the program almost tripled. According to the trend, it can be assumed that already in 2025 the program will try to enter the top ten leaders in the direction.

Frequently Asked Questions

The initial Type D visa is issued for 90 days from the date of entry into Romania. This period is intended for applying for a temporary residence permit (residence permit) directly on the territory of the country. It is important to note that the visa is a single—entry visa – the border crossing must be carried out during its validity period specified in the stamp.

To confirm remote work, you must provide an employment contract with a company registered outside Romania, or proof that you are the owner of a company registered at least 3 years before submitting the application. You will also need company identification data: name, address, tax number, field of activity, and information about the legal owners.

The standard time for processing documents is 2 weeks when submitted through the online portal of the Romanian Immigration Service. However, during peak periods (May-June and September-October), the review may take up to 30 calendar days. Tracking the status of the application is available through the personal account on the portal, provided that the biometric identification procedure is completed.

The visa application must be submitted no earlier than 3 months and no later than 14 days before the planned date of entry into Romania. This requirement is related to the need to synchronize the validity periods of accompanying documents (medical insurance, criminal record certificates), which should remain relevant at the time of border crossing.

It is necessary to provide a work certificate or payment receipts confirming that the monthly income for the last 6 months is at least 3 average salaries in Romania. In 2025, this amount is about 4,100-5,180euros per month. It is required to confirm this income level for each of the 6 months prior to submitting the application.

Proof of income requires notarization of bank statements (30-50€ per document) and translation of financial documents into Romanian (20-40€ per page). For applicants with income in cryptocurrency, an audit certificate on the legality of funds is required, the cost of which reaches 800-1,200 €.

The passport must remain valid for at least 6 months after the date of application. The certificate of non-criminal record is considered relevant within 3 months from the date of issue. Financial documents (income statements) are provided for the last 6 months preceding the application. The rental agreement must cover a period of at least 90 days for a visa and 6 months for a residence permit.

Medical insurance must be valid for the entire period of stay in the country (initially 90 days) and have insurance coverage of at least 30,000€. To obtain a residence permit after the D visa, you will need to apply for new medical insurance already in Romania.

The primary insurance for the D visa must cover a minimum of 90 days with a coverage amount of 30,000€, which costs 200-350€ depending on the age of the applicant. For a residence permit, you need to apply for a local policy through a Romanian insurer worth 450-600 € per year, including dental services and emergency hospitalization. Specialized packages for digital nomads are offered by insurers Euroins and Groupama.

It is necessary to provide a certificate of non-criminal record from the country of origin and from the country of current residence. The certificate must be apostilled or legalized for recognition in Romania.

To confirm the place of residence, you must provide a rental agreement, a hotel reservation, or documents confirming ownership of real estate in the country. When applying for a residence permit after obtaining a D visa, you will need a long-term rental contract.

The minimum rental period for a D visa is 90 days with a prepayment of 1,500-2,000€ for an apartment in Bucharest or 900-1,200€ in the regions. When applying for a residence permit, a contract for 6-12 months is required with a deposit of monthly rent (on average 600-800 €/month). Many agencies charge a commission of 10-15% of the annual rental price for the selection of housing.

It is necessary to provide a document confirming the payment of taxes in the country of residence, as well as a certificate confirming the absence of past or present facts of fraud or tax evasion. It is important to note that digital nomads are exempt from paying income tax in Romania for the first 6 months of their stay.

All documents must be submitted in the original and translated into Romanian. Translations must be performed by accredited translators in Romania or legalized in their home country. It is important to note that many applicants face the problem of non-recognition of transfers made in their country of origin.

After arriving in Romania on a D visa, you will need to apply for a residence permit: an employment contract, a certificate from the employer, a new medical insurance issued on the spot, a medical certificate of examination and a long-term housing contract. A residence permit after a digital nomad visa is initially issued for 6 months with the possibility of extension for 1 year.

Family members (spouse, minor children) can join the main applicant 3 months after receiving a residence permit. A reunification permit is issued for a period that coincides with the period of validity of the main residence permit, but not exceeding 1 year. For an extension, a re-confirmation of financial security is required.

During the first 6 months of the residence permit, digital nomads are prohibited from entering into contracts with Romanian companies. After this period, employment in the local market is possible, provided that the immigration authorities are notified and the general tax rate is 10%. Violation of this rule will result in cancellation of the status and a ban on re-applying for a visa for 2 years.

At the first stage, it is necessary to pay a consular fee of 120€ for the type D visa review. When applying for a residence permit within the country, an additional administrative fee of 120 € is charged for issuing a resident card. These payments are non-refundable in case of refusal. The costs of translating documents (15-25€ per page) and legalizing certificates through apostille (50-100€ per document) are separately taken into account.

Additional expenses include Romanian language courses for the extension of a residence permit (300-500 € for level B1), postal services for forwarding documents between authorities (50-80€), electronic signature for tax reporting (70 €), re-registration of insurance when changing residence (100-150 €).

To reunite with a spouse and children, you will need an additional payment of 80 € for each family member when applying for a D visa, a separate residence permit fee of 120 € per person, an increase in the confirmed income by 30% for the spouse and 15% for each child, medical examinations for all family members (250-400 € in total). The total expenses of a family of 3 reach € 6,200-7,500, including insurance, apartment rent and document transfers.

No, obtaining Romanian citizenship through a digital nomad visa is not possible directly. The Digital Nomad Visa (Type D) provides a temporary residence permit that allows you to stay in the country for up to 12 months with the possibility of an extension for another 12 months, but it does not lead to citizenship.

Obtaining Romanian citizenship requires compliance with the standard conditions of naturalization, including continuous residence in the country for at least 8 years with a residence permit or 5 years with permanent residence status.