In 2023, Spain launched the Digital Nomad visa program – which quickly earned its place of honor in the list of visas for remote workers and is currently in the TOP-5 programs. The visa can be obtained for up to 3 years with the right to extend for another 2 years. After living in the country for 5 years, you receive a permanent residence permit, and after another 5 years, an EU passport.

A digital nomad visa is issued at the Spanish Consulate General at the place of residence. In Spain, foreign citizens apply to an accredited center or online directly to the Ministry of Integration, Social Security and Migration (UGECE). The processing period is 3 weeks.

Specifics of the Freelance Visa in Spain

Digital Nomad is a generalized name for visas for foreigners who want to work remotely using digital technologies and receive income from abroad. Unlike a work visa, it does not give the right to enter into contracts with local employers, but it does open the prospect of obtaining permanent residence. There is an exception for Spanish freelancers. If the applicant operates as an individual entrepreneur, he has the right to receive income in Spain in the amount of no more than 20% of the freelancer’s total income.

For foreigners, a nomad visa has become a convenient way to move to a European country. Requirements for applicants:

- A confirmed income of €2,800 per month;

- Income must be confirmed by either an employment contract and/or a bank statement (for individual entrepreneurs and self-employed individuals);

- No criminal record.

Thinking about applying for a visa? A free guide will help you understand all the intricacies and nuances; it contains all the information necessary to obtain the status.

Taxes in Spain for Freelancers

Foreigners residing on a nomad visa for at least 6 months a year pay income tax at a rate of 24%. The percentage for the self-employed and “nomads” is calculated depending on the region and the amount of earnings.

But tax residency can be counted not only by the number of days spent in the country. Other ways:

- There is a center of human economic interests in Spain (for example, a business is registered there);

- In Spain, there is a center of human vital interests (this can include owning real estate or having a family in the country).

In order to avoid double tax, residents bring a payroll. If, for example, 15% is paid instead of 19%, the missing 4% is deposited to the bank. To optimize high rates, they turn to a hester, a tax lawyer.

Tax table for digital nomads, freelancers, self-employed and sole proprietors

| Tax name | The amount of tax | Note |

| Income Tax (IRPF) | 19-47% (progressive scale) 24% (up to 600,000€/year according to Beckham’s law) |

For tax residents (stay of more than 183 days). Standard rates: up to € 12,450 – 19%, 12,451–20,200€ – 24%, up to 35,200€ – 30%, up to 60,000€ – 37%, up to 300,000€ – 45%, over – 47%. For digital nomads, according to Beckham’s law, there is a 24% fixed rate on the first 600,000€ of income |

| Value Added Tax (IVA) | 21% (standard) 10%, 4% (preferential) 0% (for services outside the EU) |

Mandatory for sole proprietors and companies with a turnover of more than 85,000€/year. The rate is 0% for exporting services and working with non-EU clients. |

| Social contributions (Seguridad Social) | 60-283€/month | For the self-employed (autónomos): – First year: 60€/month (80% discount) – 13-18 months: 141€/month (50% discount) – 19-24 months: 198€/month (30% discount). For sole proprietors without benefits – 283€/month |

| Municipal Tax (IBI) | 0.4–1.3% of the cadastral value | For property owners. The rate depends on the municipality. |

| Tax on dividends | 19–23% | For residents: 19% (up to 6,000€), 21% (6,001–50,000€), 23% ( from 50,000€). For non–residents – 19%. |

| Corporate income tax | 25% | For companies (S.L., S.A.). Does not apply to the self-employed and freelancers. |

| Special mode for IT specialists | IRPF exemption for income over 10,000€/year | Available to those registered in the RETA registry as IT specialists. |

How much does the visa cost?

The cost of obtaining residency includes expenses for the government duty – €73 per person and a visa fee – €90, cards – €16. Additional costs include simple/sworn translations and apostille. On average, processing costs around €500.

In the table below, we have written what expenses foreigners will have when applying for a digital nomad visa to Spain in 2025.

Additionally, you need to take into account the cost of the flight to Spain from your place of stay, as well as the cost of accommodation, depending on your requirements for the standard of living.

| Fees, duties and other expenses for obtaining a visa | Cost |

| The fee for each family member | 90 € |

| Insurance | up to 1000 € for 1 family member |

| The application for a card | about 16 € |

| Translations of all documents into Spanish | about 320 € |

| Full support of visa processing | from 1350 € |

| Residence permit for students | from 1150 € |

| Residence permit through business registration | from 7500 € |

| Residence permit for financially independent persons | from 4200 € |

In addition, you need to take into account the cost of a flight to Spain from your place of stay, as well as the cost of living, depending on your requirements for the standard of living.

Required Documents and Requirements

Documents in Russian must be translated and apostilled. When applying in Spain, an additional proof of residence in the consular district is required. The list includes:

- Visa application;

- Photo and copy of the passport with at least 1 year remaining validity;

- Bank statement;

- Criminal record certificate with an apostille;

- Proof of collaboration with a company: for employees – a contract, for self-employed/sole proprietors – contractual relationships with terms and conditions;

- Extract from the registry to prove the existence of a legal entity;

- Employer’s cover letter;

- Diploma copies;

- Medical insurance from an accredited agency;

- Commitment to register with social security;

- Receipt for payment of government duty and visa fee.

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Family members attach passports/birth certificates to confirm relation to the applicant. Spouses need a marriage certificate or a document proving cohabitation. When obtaining a visa in Russia, upon arrival in the country, it needs to be validated, and a month before expiration, an application for larga duración must be submitted.

Recent Changes in Visa Matters in Spain

Recently, the Spanish Congress passed a law as part of the Digital Spain 2026 Agenda aimed at developing technological companies and attracting qualified specialists from third countries who wish to work remotely.

The fifth amendment to the law last December on developing the business ecosystem of companies made significant changes. It removed bureaucratic barriers, opened new opportunities for nomads, simplified the tax regime, and eliminated the requirement to pass a language exam.

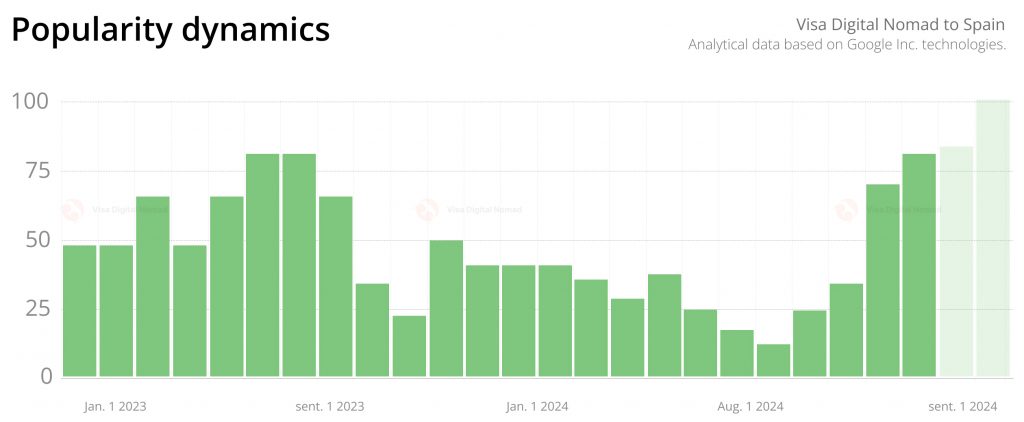

All the changes that have occurred over the past year have had a positive impact on the dynamics of interest in the Spanish digital nomad visa, preventing the demand for it from sagging significantly in the early summer of 2024, as happened with most programs. Data from Google Trends and Yandex.Wordstat make it clear that demand for it will be consistently high until the end of the year.

Frequently Asked Questions

The initial visa is valid for 12 months, which allows you to enter Spain and apply for a residence permit. The exception is applicants with employment contracts that are valid for less than a year. In such cases, the visa is issued for the duration of the contract.

The first residence permit card is issued for 3 years, subject to an indefinite employment contract or stable freelance income. If a contract with a foreign company is concluded for a fixed period of less than three years, a residence permit will be issued for the duration of the contract. To extend your residency, you will need to confirm compliance with the terms of the program, including minimum income and tax deductions.

The procedure consists of 10 steps:

- Obtaining a NIE (foreigner’s identification number) through the consulate.

- Obtaining a Schengen visa for entry.

- Obtaining an electronic digital signature (EDS) via FNMT.

- Electronic application for a residence permit through the MigraPortal platform.

- Waiting for approval (up to 20 business days).

- Registration for biometrics via the CITA system (waiting period is 2-4 weeks).

- Payment of the state duty on the form 790 012.

- Handing over biometric data to the police.

- Waiting for the production of the resident’s card (30-45 days).

- Obtaining a physical residence permit card.

The total duration of the process is 3-6 months.

After submitting the documents to the Ministry of Integration, the application review period is up to 20 working days. However, as a rule, the total period from submission to receipt of a resident’s card reaches 2-3 months due to the need to register for biometrics (CITA) and produce a physical document. Delays are possible in Madrid and Barcelona due to the high workload on migration services.

The extension of the residence permit is possible for 2 years, provided that the status of a remote employee and income are not lower than the established minimum. The application is submitted 60 days before the expiration of the current residence period. The review takes 30-45 days, after which a new card is issued. It is important to keep in mind that for an extension it is necessary to confirm residence in Spain for at least 183 days a year.

Medical insurance must be active at the time of applying for a visa. It is recommended to apply for a policy 1-2 months before contacting the consulate by choosing a Spanish insurance company with coverage starting from 30,000€. The deadlines are the same for family applicants, but individual insurance is required for each family member.

The certificate of absence of criminal record is valid for 3 months from the date of issue. Bank statements – no more than 30 days as of the application date. Employment contracts must have a remaining validity period of at least 6 months at the time of application. Translations of documents do not have a statute of limitations, but the notarization must be up–to-date.

Family members can join the main applicant at the same time or within 90 days after receiving the residence permit. Documents for reunification are considered for 15-30 days. At the same time, the validity period of their residence cards will coincide with the period of residence permit of the main applicant. Additional proof of financial dependence will be required for children over the age of 18.

If your visa expires earlier than you have received a resident card, you must submit a request for prolongation of your legal stay through the MigraPortal electronic system. 10 working days are given for consideration of the application, during which you can stay in the country. In case of delays in the production of a residence permit card due to the fault of the migration services, a temporary residence permit (Autorización de Regreso) is issued.

All documents must be translated into Spanish. Sworn translations (traducción jurada) performed by accredited jurado translators are required for work contracts. Ordinary documents can be translated by an ordinary translator, but official documents, especially those confirming an employment relationship, require a certified translation.

To confirm income (at least 2,763 € per month for 2025), you must provide bank statements for the last 3 months, an employment contract indicating salary, a certificate or letter from the employer indicating the position and amount of payment. For freelancers, there are invoices for several months and certificates of completed work.

Family members require documents confirming family ties (marriage certificates, birth certificates), personal documents (passport, photographs, questionnaires), individual medical insurance, certificates of absence of criminal record, power of attorney from each relative (the parent signs for the child).

Yes, you need to confirm your registration in Spain. A long-term rental agreement and documents on the purchase of real estate are suitable for this. At the time of submitting the application at the consulate, it is sufficient to confirm residence in the consular district (for example, with a copy of the page of the citizen’s passport with the registration address).

Medical insurance must be issued in Spain, have coverage of at least 30,000 euros per person, cover the entire period of stay in the country, include basic medical services, and be individual for each family member.

No, it is not necessary to open an account with a local bank to apply for a Digital Nomad Visa and a residence permit. You can use bank statements from foreign banks to verify income. However, after obtaining a residence permit, opening a bank account in Spain will be convenient for everyday life.

It is necessary to provide a certificate of absence of criminal record for the last 5 years, from all countries where the applicant had a residence permit or lived for more than 6 months, with an apostille, with a translation into Spanish. The limitation period of the certificate should not exceed 3 months at the time of submission.

The standard period for reviewing a Digital Nomad visa application is 20-45 days from the date of submitting the full package of documents. In exceptional cases, for example, if additional checks by the employer are necessary or income data is clarified, the period may be extended to 60 days. To speed up the process, it is important to provide documents with clearly legible company details and certified translations.

Prices vary depending on the delivery method. When applying through the consulate, the consular fee is 80 €. When applying from Spain, the state fee for the resident’s card is 16.08€. Additionally, transfers (from 50 €/document), legalization of documents (from 100 €) and services of migration lawyers are paid.

The main payments to the Spanish budget are the visa fee (80€), the fee for a residence permit form 790 012 (16.08€), the production of a TIE card (18.92€), the extension of a residence permit (21.02€). For families of 3 people, the total amount of fees reaches 350€.

Hidden costs include sworn translations of documents (70-150 € per page), medical insurance (from 600 €/year per person), apostillation of certificates (50-100€ per document), rental of housing to confirm the address (from 800 €/month. in large cities), courier services for the delivery of documents (50-200 €).

The Digital Nomad Visa provides for an income tax of 15% for the first 4 years (under the Non-Resident regime). Social contributions – 29.9% of income (paid by the employer). Property tax – 0.2–2.5% of the cadastral value of housing. For a family with an income of 4,143 €/month, the annual tax deductions will amount to 7,400€.

Yes, it is possible to obtain Spanish citizenship through a digital nomad visa, but this is a long-term process. The Digital Nomad visa allows you to first obtain a residence permit (residence permit), which is issued for 3 years with the possibility of extension for another 2 years. After 5 years of continuous residence in Spain with a residence permit, you can apply for a permanent residence permit (permanent residence). And after another 5 years of permanent residence, you can apply for Spanish citizenship, which in total requires at least 10 years of residence in the country.

At the same time, it is important to comply with the conditions: to live in Spain for at least 183 days a year, pay taxes, do not break the law and integrate into local society. However, it should be borne in mind that Spain does not recognize dual citizenship with most countries, with the exception of some Latin American states.