The Digital Nomad Visa (GoTürkiye) program in Turkey was announced in April 2024, but the official launch was only in October 2024. The program was created so that freelancers, IT specialists, entrepreneurs and representatives of other professions could move to the country and combine work with life in comfortable conditions. In addition to a rich cultural heritage, warm climate, affordable cost of living, Turkey can offer a long-term residence permit (for 12 months with the possibility of extension) and the opportunity to relocate a family. The main income requirement is from $ 3,000 per month. Thanks to loyal requirements, Turkey is one of the most attractive countries for digital nomads today.

The digital nomad visa is a new direction for Turkey, but it has already become one of the most popular. Our free guide will help you understand all the intricacies and nuances. It contains all the information necessary to obtain the status.

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Upon application approval, the candidate is issued an identification certificate. This becomes the basis for applying at a Turkish consulate and obtaining a freelancer visa. The document review period takes 4 weeks. The cost of the visa has not yet been specified on the embassy website or at visa centers.

Specifics of the Freelance Visa in Turkey

Holders of the Digital Nomad visa are promised an attractive lifestyle. Primarily, specialists from abroad are wanted in Istanbul, the Dalaman and Mugla provinces, and other cities with developed office infrastructure. The rapidly growing nomad community helps with adaptation in the country, networking, and professional growth. Before applying to participate in the program, the candidate requirements must be studied. There are really many advantages and here are the main ones:

- No requirements for knowledge of the Turkish language.

- No need to take out health insurance or rent housing at the time of applying for a visa.

- The freelancer card is provided for 12 months with the right to extend.

- Relatively affordable housing and cost of living compared to European countries or the USA.

- Convenient geographical location opens up wide opportunities for travel.

- Government institutions provide high-quality and affordable medical care.

- The spouse and children of the main applicant have the right to obtain a residence permit for a similar period.

A digital nomad visa can be obtained if you meet the following requirements:

- Higher education (the type of diploma does not matter).

- Age compliance (from 21 to 55 years).

- Citizenship of one of the countries included in the list of permitted.

- Proof of monthly income of $3,000 for the last 6 months.

- Proof of relevant experience as a freelancer or remote employee.

- Provide an employment contract (for remote employment).

- Provide a certificate of absence convictions.

The Minister of Industry and Technology noted that Turkey aims to be part of the global technology ecosystem and is ready to offer promising specialists favorable conditions. For many remote workers, these will become a springboard in their careers.

Support mechanisms for startups have been created, including business incubators with services tailored to the specifics of the activity and business accelerators with advisory assistance. Relocators are helped with renting offices in technoparks, co-working centers, and access to financial-analytical information and Türkiye technologies.

Taxes in Turkey

If a foreigner stays in the Republic for up to 183 days per year, he/she is not a tax resident and must pay taxes only on income received from Turkish companies. Tax residency occurs if a foreigner stays in the country for more than 183 days per calendar year. In this case, taxes must be paid on global income (received from abroad). The following tax rates are currently in effect in Turkey.

Personal Income Tax (PIT)

Residents of Turkey are subject to a progressive tax scale:

- Up to ₺110,000 – 15%

- From ₺110,001 to ₺230,000 – 20%

- From ₺230,001 to ₺1,900,000 – 27%

- Over ₺1,900,000 – 35-40%

Value Added Tax (VAT)

VAT in Turkey is 20% for most goods and services. Digital nomads generally do not pay VAT unless they do business in the Republic.

Social Contributions

If a digital nomad does not work for a Turkish company and does not have the status of an individual entrepreneur, then social contributions (pension, health) may not be paid. They can be paid voluntarily in order to gain access to the state health system (SGK).

Tax Incentives and Agreements

Turkey has double taxation treaties with more than 80 countries. When paying taxes in their home country, a foreigner can avoid double taxation in Turkey. To prove the fact of payment, it is necessary to provide relevant evidence to the tax authorities. Digital nomads who are not residents of Turkey may not pay taxes on foreign income if they do not transfer these funds to Turkey.

Declaration of income

If a digital nomad has the status of a tax resident, he/she must submit a tax return. The deadline for filing documents is the end of March of the year following the reporting year. Non-residents declare only income received in Turkey.

Property taxes

When owning real estate in Turkey, a foreigner must pay property tax. The rate varies from 0.1% to 0.6% of the cadastral value of the property. When purchasing, a tax on the change of ownership is levied (4% of the value).

Registration costs

| Fees, duties and other expenses for obtaining a visa | Cost |

| Medical insurance with a validity period of 1 year or more | from 60 € per year |

| Rental housing | 500 € -1 400 € |

| Full support of visa processing | from 1700 € |

Important addition. From April 1, 2025, new insurance limits for Yabancı Sağlık Sigorta (YSS) policies, which are mandatory for obtaining a residence permit in Turkey, will come into force. The new conditions imply the following rates:

- Outpatient treatment: ₺15,000 (currently ₺5,000)

- Inpatient treatment: ₺150,000 (currently ₺50,000)

What does this mean in practice?

The cost of insurance will definitely increase. The exact prices have not yet been announced, but an increase is expected. From April 1, 2025, migration centers will only accept policies with the updated limits. Therefore, when planning to apply for a Digital Nomad Visa, apply for a residence permit as soon as possible to avoid paying higher rates. At the moment, policies with new limits are not yet available. It is worth remembering that the requirements will change from April 1, 2025.

If you take a policy with minimum coverage, the price of insurance in 2025 will be:

- for persons 18-35 years old – 1300₺ per year;

- for persons 36-45 years old – 1800₺ per year;

- for persons 46-55 years old, under 18 – 2100₺ per year;

- for persons 56-60 years old – 2700₺ per year;

- over 60 – from 3000₺ per year

It is worth factoring in housing costs. As of March 2025, the rental prices in Istanbul are as follows:

- 1-room apartment (city center) – ₺35,051;

- 1-room apartment (outside the center) – ₺22,117;

- 3-room apartment (city center) – ₺63,765;

- 3-room apartment (outside the center) – ₺37,207.

Necessary Documents and Requirements

The main requirements for the applicant’s dossier are similar to those of European countries that issue visas for nomads. You can see the list of the main documents on the website digitalnomads.goturkiye.com. To create a dossier need to prepare:

- Application form.

- Diploma of higher education (required), original + copy.

- Original passport valid for at least 6 months from the date of departure to Turkey and at least 2 blank pages + a copy of its first page.

- A copy of the passport with the registration page.

- 2 biometric photographs. Requirements for the photo: on a white background, not older than 6 months, with a full-face image, clearly visible face, size 5×6).

- Admission letter from the Ministry of Culture and Tourism of Turkey (required).

- Reservation of an air ticket to Turkey and back for a period of no more than 90 days.

- Confirmation of accommodation in Turkey (hotel reservation, certificate of ownership / lease agreement for real estate, notarized invitation).

- A certificate of employment from an employer in Russia. Indicating the position, salary and date of employment, information that the job will be kept after returning to the Russian Federation, the date of issue of the certificate. The document must be certified by the signature of the responsible person and the company seal. For freelancers: a contract for the project that he/she is working on, indicating all the details of the project.

- Bank account statement. Information must be provided with the movement of funds for the last 6 months and information on the balance.

- A document indicating the details of the applicant’s parents + a copy.

Recent Changes in Visa Issues in Turkey

The launch of the national nomad visa sparked debates. According to public feedback, the program is less suitable for Russians. People express mistrust towards the local authorities. This is related to the fact that in 2023, they were frequently denied extensions of residence permits and were forced to leave the country. Many disliked the high monthly income requirement, especially when the minimum wage in Turkey is only $550. After exploring programs in other countries, they advise less affluent expats to consider Spain, Montenegro, and Italy, which have lower financial requirements. How correct they are will be seen in the coming months.

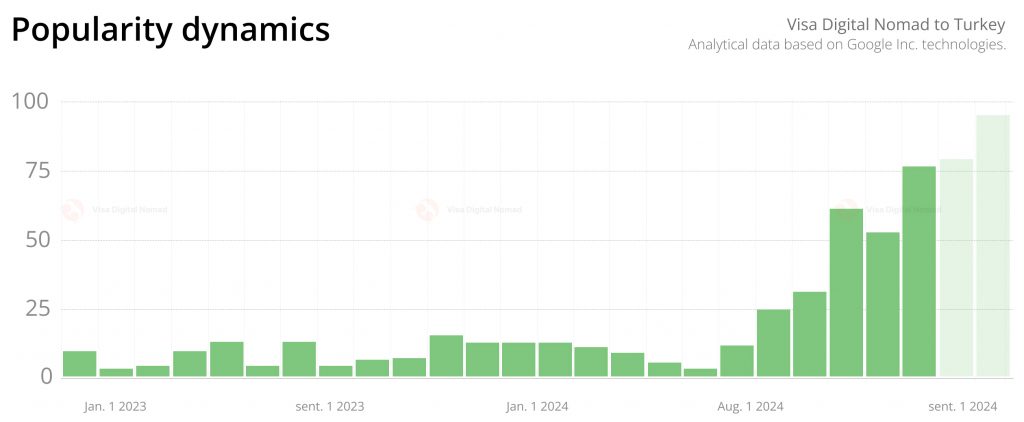

However, so far, the dynamics of popularity according to Google Trends shows the opposite: as of mid-summer 2024, there is a tendency to be included in the list of the most popular visas by destination. This may be due to the general trend of growing demand for such programs around the world.

Frequently Asked Questions

The passport must remain valid for at least 6 months from the date of planned entry into Turkey. For example, when applying on May 1, 2025, the passport must be valid at least until November 1, 2025. However, some consulates require a “reserve” of 3 months after the end of the visa period.

You must provide bank statements showing a monthly income of at least $3,000 or an annual income of $36,000. The statements must be up-to-date and formalized.

Yes, higher education is a prerequisite. You must provide a diploma or a certificate of higher education to confirm your qualifications.

For some applicants, you will need to provide a certificate of absence of criminal record from the country of residence. This is one of the documents that is requested depending on the applicant’s specific situation.

Yes, when submitting an application, you must specify the address of your planned residence. If you have a rental agreement, it should also be attached to the documents.

First, you need to obtain a digital nomad identification certificate through the official Digital Nomads GoTürkiye portal. After receiving the certificate, you need to make an appointment for a visa appointment at the Turkish consulate or visa application center. If you are already in Turkey on a tourist visa, you can apply for a residence permit directly at your local migration office.

Depending on individual circumstances, additional documents may be required, such as tax returns, work portfolios, or other evidence of professional activity. If you open a business in Turkey, you will have to prepare the appropriate package of documents.

The average processing time for an application is 1-4 weeks after submitting a complete set of documents. However, during peak periods or if additional checks are required, the process can take up to 6 weeks. It is important to keep in mind that the countdown begins from the moment of receiving the digital nomad certificate through the Digital Nomads GoTürkiye portal, which is issued in advance.

The initial visa is granted for 90 days with the right to apply for a subsequent residence permit (residence permit). After switching to a residence permit, the period of legal stay increases to 1 year with the possibility of extension. This is a two-stage system in which a visa serves as the basis for requesting long-term residency.

It is recommended to start the process 2-3 months before the expected moving date. It should be noted that it may take 2-4 weeks to obtain a certificate; up to 1 month to review a visa application; up to 10-14 days for administrative procedures after approval.

Spouses/children are included in the application at the same time as the main applicant, which increases the total processing time by 7-10 days. Separately submitted petitions are considered for 3-4 weeks. For children over the age of 12, a personal appearance is required to submit biometrics, which requires additional time.

Officially, the program does not provide for urgent processing.

After entering with a digital nomad visa, it is necessary to apply for a residence permit within the first 30 days. Delay entails fines of up to 5,000 TL and cancellation of the certificate. At the same time, the 90-day visa period starts from the date of border crossing, and not the issuance of the document.

If you stay for more than 183 days per year, you will receive the status of a tax resident. Reports are submitted by March 31 of the following year, and taxes are paid by the end of April. Digital nomads who have issued a Turkiye Tech Visa are exempt from taxes for the first 3 years, subject to annual proof of income.

The main expenses include a consular fee of $236 for Russian citizens and $216 for other foreigners. These payments are made when submitting documents to the visa application center or consulate. Additionally, a service fee for processing the application is required — about $30-50, depending on the region of application.

The digital Nomad certificate is issued free of charge through the Digital Nomads GoTürkiye portal. However, the preparation of documents for obtaining it (notarization of the diploma, certification of the employment contract) can cost $ 100-200. Some applicants use interpreters, which increases costs by $50-80.

Most landlords request a deposit of 2-3 monthly payments. For example, if you rent for $ 300 /month, you will need to deposit $600-900. These funds will be refunded upon departure if there was no damage to the property.

When switching to a residence permit, the following are added: state fee for a resident card — $80-120; reinsurance with extended coverage — +20% of the original cost; notarization of updated documents — $50-70.

It is not possible to obtain Turkish citizenship through a nomad visa directly. The Digital Nomad visa provides a temporary residence permit (residence permit) for a period of 1 year with the possibility of extension, but it does not grant the right to citizenship or permanent residence (permanent residence).