Relevance of the Digital Nomad Visa

Although digital nomads have existed for almost as long as the internet itself, prior to the COVID-19 pandemic, this lifestyle was only feasible for individuals occupying niche positions in a narrow range of industries.

Post-pandemic, millions of workers have transitioned fully to remote work, making it much more accessible. One no longer needs to be a top executive to travel the world and still earn a good salary.

Overall, over 60 countries worldwide offer some form of digital nomad visa. However, not all of them provide tax benefits for freelancers. In this guide, you will find a list of countries offering genuinely advantageous conditions for remote work.

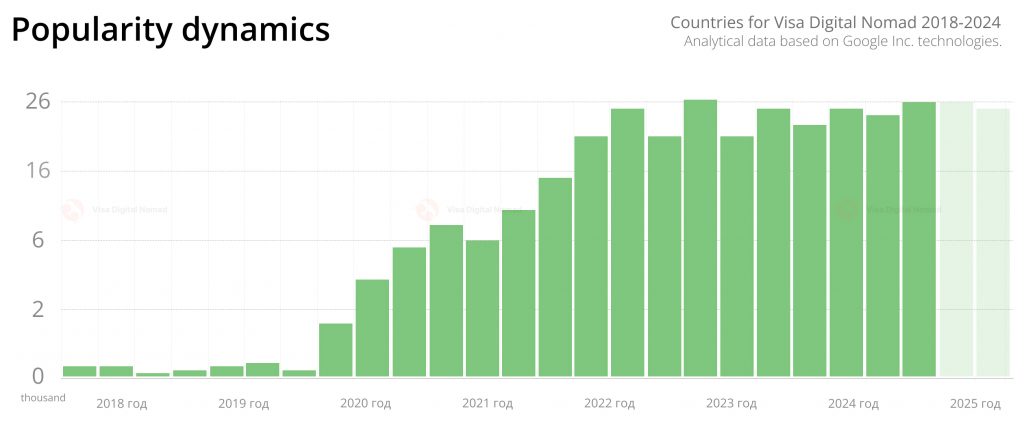

In recent years, Russia has seen a surge of interest in the topic of “digital nomads” according to data from Google Trends and Yandex.Wordstat. Since 2020, demand for this status has doubled, and by 2022, it had quadrupled. The trend suggests that the growth trajectory will continue into 2025.

List of Low-Tax Countries

Italy

Digital nomads are required to pay taxes in Italy, but there is a special regime. The simplified tax system allows self-employed foreigners earning up to €65,000 per year to pay a fixed rate of 5% for the first 5 years.

- Residence permit requirement: Permanent presence in Italy for more than 183 days during the calendar year.

- Taxes: After the preferential period – up to €15,000 (23%), from €15,000 to €28,000 (25%), from €28,000 to €50,000 (35%), over €50,000 (43%).

- Corporate tax rate: 24%.

- On dividends: 20%.

Bulgaria

Offers attractive tax benefits for freelancers, making it an ideal choice for those who want to move here and work remotely. Despite inflation, Bulgaria remains an affordable haven for a large community of digital nomads.

- Tax residence permit requirement: Permanent residence for at least 6 months during the calendar year.

- Income tax: Fixed rate for residents and non-residents at 10%.

- Corporate tax rate: 10%.

- On dividends: 5%.

Romania

One of the most underrated countries in Eastern Europe. Offers comfortable living conditions, excellent internet infrastructure, alongside attractive preferential taxation.

- Residence permit requirements: No need to reside for 183 days, but special conditions apply.

- Income tax: Like neighboring Bulgaria, Romania applies a fixed rate of 10% on income earned in the country and 0% on income earned abroad.

- Corporate taxation: The basic corporate income tax rate is 16%. However, Romania offers a special regime for microenterprises, where a 1% tax is levied on their income.

- On dividends: 8%. However, if the total amount of dividends exceeds around €3,600, an additional social contribution of 10% applies.

Croatia

Offers a 12-month digital nomad visa, exempting its holders from income tax during their stay in the country. The taxation principle is simple: if you’re not working for a Croatian company, you don’t need to pay taxes.

- Attainment of “resident” status: Presence in the country for at least 12 months.

- Corporate tax: Progressive rates apply – from 15 to 35.4%. For remote workers, the rate is 0% for the year.

- Corporate tax rate: 10% for incomes up to €1,000,000 and 18% for incomes exceeding €1,000,000.

- On dividends: 10% on dividends and profit shares.

Albania

Attracts many digital nomads with its affordable cost of living and excellent internet infrastructure.

- Tax residence permit requirement: Residing in Albania for at least six months within a 12-month period. However, with own property, status is granted earlier.

- Taxes: Progressive scale for residents and non-residents – up to €40,000 (0%), from €40,000 to €50,000 (6%), over €50,000 (13%).

- Corporate fees: 15%

- On dividends: 8%

Greece

One of the most interesting destinations for digital nomads. A freelancer not buying property or a car in Greece may not pay taxes, even if staying in the country for over 183 days per year.

- Residence permit assignment: Permanent residency in Greece for six months.

- Tax requirements: Resident incomes are taxed on the following scale: 0-€20,000 (22%); €20,001-€30,000 (29%), €30,001-€40,000 (37%), over €40,000 (45%). For non-resident freelancers, the rate is reduced by 50%, i.e., the maximum rate for incomes over €40,000 is 22%.

- Business taxes: 22%

- On dividends: Fixed fee at 5%.

Cyprus

The combination of favorable tax rates and exemptions makes Cyprus an excellent choice for digital nomads seeking a conducive environment for living and working.

- Attainment of tax residency status: Continuous residency on the island for a 12-month period from January 1st to December 31st of the current year.

- Personal income tax: Residents are taxed at rates ranging from 20% to 35%. Non-residents – a progressive scale from 0% for incomes up to €19,500 to 35% for incomes over €60,000.

- Corporate contributions: 12.5%

- On dividends: 0%.

Serbia

Actively attracts digital nomads with new tax incentives. Under the digital nomad program, foreigners can enjoy a zero tax rate on income earned while working in Serbia for up to 90 days.

- Belonging to Serbian residency: Residing for at least six months.

- Profit tax: After the preferential period, non-residents are obligated to pay taxes ranging from 10% to 20%. The rate depends on the type of activity.

- Corporate rate: 15%

- On dividends: 20%.

Portugal

The visa program for “remote workers” offers enticing benefits, including untaxed income earned abroad and on cryptocurrency operations.

- Conditions for obtaining tax residency: Continuous residence for 183 days.

- Taxes: Foreigners earning income in Portugal as non-residents must pay taxes at a rate of 25%. The standard individual income tax ranges from 14.5% to 48%.

- Corporate taxation: 21%

- On dividends: 25%

Georgia

Georgia’s favorable tax scheme for sole proprietors is the main criterion for choosing this country as a place for remote work. The program involves paying only a 1% tax on gross business income.

- Residence permit obtaining: An individual is recognized as a tax resident of Georgia if they have actually been in Georgia for 183 days or more during any continuous 12-month period.

- Taxation: Income earned from foreign sources is not subject to taxes. The standard income tax rate is 20%.

- Corporate payments: 5.75%

- On dividends: 5%

Attractive tax regimes allow freelancers to significantly reduce their overall tax burden, freeing up valuable resources for business development and professional advancement. Learn more about visa requirements and how to apply for a digital nomad visa in any of the mentioned countries.

Comparative table of basic tax conditions

| Country | Residency requirement | Income tax | Corporate tax | Tax on dividends |

| Italy | more than 183 days a year | 5% (first 5 years), then 23-43% | 24% | 20% |

| Bulgaria | from 6 months a year | 10% | 10% | 5% |

| Romania | Special conditions | 10% (in the country), 0% (abroad) | 16% (1% for micro companies) | 8% |

| Croatia | more than 12 months | 0% (first year), then 15-35.4% | 10% (up to 1 million euros), 18% (over 1 million euros) | 10% |

| Albania | more than 6 months | 0% (up to 40,000€), 6-13% (over 40,000€) | 15% | 8% |

| Greece | more than 6 months | 11-22.5% (for non-resident freelancers) | 22% | 5% |

| Cyprus | 12 months | 0-35% (progressive scale) | 12,5% | 0% |

| Serbia | from 6 months | 0% (90 days), then 10-20% | 15% | 20% |

| Portugal | more than 183 days | 25% (non-residents), 14.5-48% (residents) | 21% | 25% |

| Georgia | more than 183 days | 20% (in the country), 0% (from abroad) | 5,75% | 5% |

Cost of living and tax burden

| Country | Income tax | Total tax burden | Relative cost of living | The quality of the Internet infrastructure |

| Italy | 5-43% | High | High | High |

| Bulgaria | 10% | Low | Low | Good |

| Romania | 0-10% | Low | Low | Excellent |

| Croatia | 0-35,4% | Average | Average | Good |

| Albania | 0-13% | Low | Very low | Excellent |

| Greece | 11-45% | Average | Average | Good |

| Cyprus | 0-35% | Average | Average | Good |

| Serbia | 0-20% | Low | Low | Good |

| Portugal | 14,5-48% | High | Average | Good |

| Georgia | 0-20% | Very low | Very low | Good |

Frequently Asked Questions

Serbia provides a zero tax rate on income earned while working on a Digital Nomad visa, provided that the nomad does not spend more than 90 days a year in the country. Similar benefits are available in Albania for incomes up to €135,000 per year. Cyprus exempts the first €19,500 of annual income from tax when applying for a nomad visa.

To do this, it is necessary to verify the existence of an international agreement between the country of citizenship and residence, confirm the status of a tax resident through an income statement, and use tax deductions for income already taxed abroad.

- In Italy, 5% for incomes up to €65,000/year in the first 5 years;

- In Bulgaria, 10% personal income tax + 5% dividend tax when applying for self-employed status;

- In Hungary, 15% on incomes up to 71,000 €/year under the simplified regime.

The 183-day rule applies in most countries of the world. This means that if you live in the country for at least 183 days a year, you will be assigned a tax residence.

- Contracts with clients/employers;

- Bank account statements;

- Certificate of absence of tax arrears from the country of citizenship;

- A copy of the Digital Nomad visa.

Yes, for example, similar benefits apply in Bulgaria and Serbia. VAT exemption for annual turnover up to 50,000€. Corporate tax rates have been reduced (10% in Bulgaria against the standard 15%). Benefits for patent payments for IT developers.

In the EU, a fine of 200-500% of the unpaid amount + criminal liability is imposed. In Serbia and Albania, fines of up to 100% of the debt amount without criminal prosecution. In some countries, assets are confiscated in case of systematic violations.

According to the country of residence, an annual declaration must be submitted with the attachment of certificates of foreign income. The EU requires electronic reporting through portals such as SII (Spain) or F24 (Italy).

- Thailand, Mexico, Dominican Republic – up to 180 days a year;

- Georgia – exemption for income from foreign sources;

- Costa Rica has a 12-month grace period for new residents.

- Rental housing (up to 30% of income in Italy);

- Insurance premiums (100% in Spain);

- Training and professional certifications (up to 15,000 €/year in the EU).

In the EU, rates increase after obtaining permanent residence (for example, in Spain from 24% to 45%). In Serbia and Albania, the benefits regime is extended for 5 years with investments starting from 50,000euros. It is mandatory to connect to the national health system.