New migration laws allow citizens of third countries to legally obtain long-term visas for remote work in Europe. IT specialists and highly qualified professionals with contracts from foreign companies and stable incomes have a chance to potentially change their citizenship in the future.

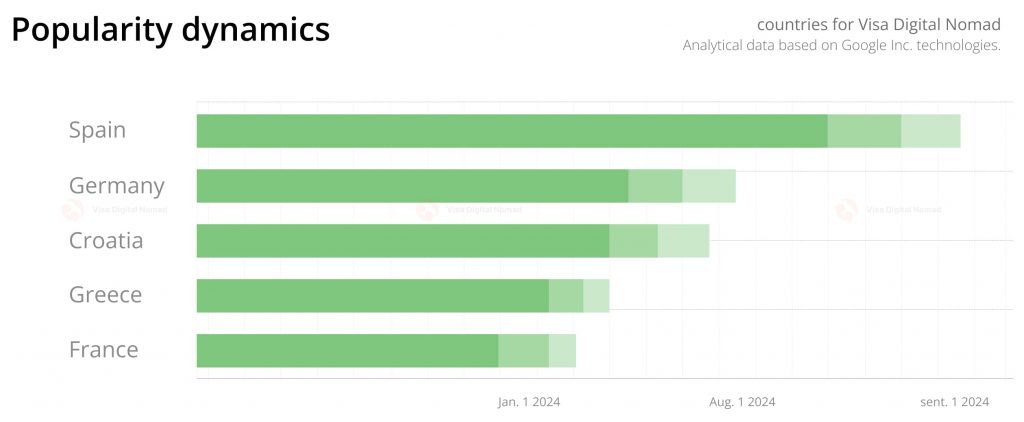

According to Google Trends and Yandex.Wordstat, Spain has led significantly in 2024 as the top choice for obtaining a “digital nomad” visa.

Spain

The national Telework Visa is designed for non-EU citizens. It is currently the only program allowing work not only for foreign companies but also for Spanish companies, provided that 20% of the profit is earned within Spain.

At the end of the term, expatriates can apply for permanent residence along with their family members, provided they have lived in the country for at least 6 out of 12 months.

Program participation requirements

Russians can apply for the visa at the consulate and in Spain. Applying in the country increases the chances of approval and reduces the processing time to 20 days. The required documents are:

- A contract or agreement for services;

- At least one year of work experience and at least three months with one employer;

- A qualification certificate;

- A clean criminal record;

- Private health insurance;

- No resident status in Spain in the last five years;

- Proof of a monthly income of €2,520, plus 75% for an adult and 25% for each child.

Translation and processing costs can reach €500.

Taxation

Until 2023, residents’ income was taxed at rates ranging from 24% to 47% depending on earnings. After recent changes in tax law, digital nomads are taxed at 15% for the first six years.

Germany

The German freelance visa (Freiberufler), valid for 1-3 years, allows obtaining temporary resident status and the opportunity to work remotely. This visa can be obtained without specific income requirements.

Program participation requirements

To obtain the Selbständiger visa, you need to provide a business plan, fill out a profile and business concept form, and outline the projected expenses. For the Freiberufler visa, the basis for issuance includes a contract with a company, recommendations from previous employers, and proof of financial stability. At the embassy, applicants must specify their profession from an approved list, verify their qualifications with a diploma, and pay a fee of €75.

To participate in the program upon arrival with a long-term visa D, you must:

- Rent an apartment and register with the Ministry of the Interior (Bürgeramt);

- Visit the tax office (Finanzamt);

- Open a bank account;

- Purchase health insurance;

- Submit documents to the Foreign Office (Ausländerbehörde);

- Pay €100 for the resident card.

Taxation

Freelancers and self-employed individuals pay income tax, turnover tax, and a preliminary income tax. The amount depends on earnings. The tax office calculates the amount due after the declaration is submitted. Residents earning less than €10,908 (as of 2023) are exempt from financial burdens.

Croatia

The country embraced the trend of digital nomadism in 2021 by launching the Digital Nomad program.

Program participation requirements

In 2023, Croatia became a member of the Schengen Area, making it an attractive country for living and working. Nomads can live in the country with their family, provided they have sufficient financial resources. For the freelancer visa, you need the following documents:

- Employment contract with a foreign employer;

- An application indicating a position related to information technology;

- A regular income of €2,870 per person and a minimum of €3,731 per family;

- A clean criminal record;

- Health insurance.

Before submitting the documents for the national visa D at the consulate, they must be translated into Croatian/English and apostilled. Upon arrival, foreigners must register their residence with the MUP district office within three days, pay €10 for administrative fees, and €45 for obtaining a biometric card equivalent to a residence permit.

Taxation

Residents with freelancer status in Croatia enjoy tax benefits. They are exempt from income tax but must pay a percentage on passive income.

Greece

In 2021, Greece launched the Digital Nomad program. It is designed for specialists from non-EU and non-EEA countries. Initially, the visa is issued to nomads for 12 months, with the possibility of extending it for another 2 years, provided they comply with migration regulations. Upon expiration, digital nomads can change their migration status for another reason, seeking employment with local employers.

Program participation requirements

Candidates submit an application for an exit visa and residency at the consulate according to the list. Upon arrival in Greece, applicants are issued a biometric residence permit card. Criteria for obtaining digital nomad status:

- A contract confirming employment relations abroad with a specified salary;

- A long-term rental agreement;

- Health certificate form No. 082;

- Insurance from a private medical company;

- Income statement;

- Monthly earnings of €3,500, plus 20% for a second parent, and 15% for each minor family member.

The visa cost is €1,000. For family travel, add €150 per adult and €16 per child.

Taxation

Foreigners receive tax resident status after 180 days. According to the law, nomads benefit from IT sector employee privileges and pay 50% of income tax for the first 7 years.

France

France does not have a digital nomad visa, but alternative programs allow obtaining a freelancer residence permit. By 2030, the authorities plan to launch 100 startups, focusing on information, industrial technologies, and business. This requires specialized foreign professionals and entrepreneurs. Selected candidates receive stamps in their passports marked “entrepreneur/freelance profession” for one year with the possibility of extension. Relocators, except Russians, can also get working holiday visas.

Program participation requirements

To participate in the program, you need:

- Education or 5 years of work experience in a relevant field;

- For entrepreneurs, a business project approved by the Ministry of Economy;

- A place to live;

- Proof of financial stability;

- An income of €2,700.

If you lack a stable income, a deposit of €21,000 is sufficient to prove financial stability. Expats planning to start a business must invest at least €30,000 in the economy. The full list of visa documents, considering the specifics of activities, is listed on the consulate website. The consular fee is €100. The application processing time is 45 days.

Taxation

Program participants are subject to progressive tax rates. If annual earnings do not exceed €10,770, they are exempt from financial burdens. For earnings of €169,000, the deduction rate is 45%.