The Serbian Digital Nomad Visa is suitable for foreigners with a confirmed income of more than 3,500 euros per month who wish to work remotely in the country and can prove this fact. This type of visa serves as a temporary freelancer residence permit, allowing work in the country for up to 12 months with the possibility of renewing the permit after a short departure from the country.

To apply and confirm an application for the Digital Nomad visa, registration at a local police station within 24 hours of arrival in the country is required. Simultaneously, an application is sent for a temporary residence permit to stay in the Republic for more than 90 days.

Specifics of the Freelance Visa

In addition to immediate registration with the police, a freelancer must take several more steps, the confirmation of which is required when obtaining the nomad visa:

- Rent accommodation.

- Obtain medical insurance.

- Open a bank account.

- Apply for a taxpayer identification number (relevant for both the self-employed and sole proprietors).

- Register a business if planning to work as a sole proprietor or a private limited company (OOO).

The program aims to attract specialists to the country who work remotely as employees in foreign companies or as business owners. However, it is important to note that in 2024 the Digital Nomad visa program has not been officially launched. This means that such residence permits are issued on an individual basis. That’s why a monthly income is so important. To obtain the visa, it is necessary to provide proof of earnings of at least 3,500 euros per month for the last six months. Similarly, family members of the digital nomad can also apply for a freelancer visa under similar conditions.

What Taxes Do Freelancers Pay?

For remote employees working in Serbia, the following tax obligations apply:

- Tax for the self-employed and sole proprietors. In this case, the tax rate is 10%. However, this condition applies to freelancers earning more than 54,000 euros per year. If the digital nomad is a resident of a country with which Serbia does not have a double taxation agreement (not relevant for Russians), then the profit tax is 20%.

- Tax for LLCs. In this case, a fixed tax rate is not applicable. The amount of tax depends on the company’s income. Essentially, this is a corporate income tax on profits, amounting to 15%. This rule applies to all LLCs regardless of their size and type of activity.

Additionally, we collected information on taxes in Serbia for digital nomads, freelancers, the self-employed and individual entrepreneurs (sole proprietors).

| Tax name | The amount of tax | Note |

| Income tax (self-employed and sole proprietors) | 10% | Applies to freelancers earning more than 54,000 euros per year. If the digital nomad is a resident of a country with which Serbia does not have a double taxation agreement (not relevant for Russians), then the income tax is 20%. |

| Corporate Income Tax (LLC) | 15% | The fixed tax rate does not apply. The amount of tax depends on the company’s income. The rule applies to all LLCs, regardless of their size and type of activity. |

| Model A (self-employed individual face) | 20% | Income can be reduced by a fixed amount of expenses in the amount of 96,000 RSD (Serbian dinars) per quarter. Contributions to social funds are calculated at the following rates: for medical insurance — 10.3%; for pension insurance and disability insurance – 24%. The minimum contribution amount is RSD 1,402 per month (RSD 4,206 per quarter). |

| Social contributions (IE) | About 35% of the minimum wage | Retirement benefits: 25% of the minimum wage. Health insurance: 10.3% of the minimum wage. |

| Lump sum tax (Sole proprietor) | 20,000–40,000 RSD per month | The tax is fixed for a year and paid in equal installments monthly. The amount of tax depends on the location and type of business. |

| Value added tax (VAT) | 20% (standard rate), 10% (reduced rate) | 20% for most products and services. Reduced rate of 10% for food, medicines, books, medical products. Companies with a turnover of more than 8 million dinars are required to register as VAT payers. |

| Income tax (freelancers) | 10% of taxable income | The fee for pension and disability insurance is 26% of the total income. The health insurance fee is 10.3% of the total income. The unemployment insurance fee is 1.5% of the total income. |

Cost of the Visa

When applying for a freelancer residence permit, you must have an amount equivalent to three months’ average income in Serbia, which is about 500 euros, on your bank account. A visa fee of 116 euros is also required.

When applying for a sole proprietor visa, it is necessary to create a business account in one of the country’s banks and deposit an amount equal to the average income in the country. Additionally, a visa fee of 173 euros and a national employment service fee of 116 euros are required. After opening a business, a registration tax of 16 euros must be paid.

- We will answer all your questions

- We will help you choose the best option

- We will guide you through every step or do everything for you

Expenses related to the procedures for obtaining long-term visas (Type D) or temporary residence permits for remote workers, freelancers and sole proprietors.

| Expense item | Size | Note |

| Visa fee (freelancer/self-employed) | 116€/ 160€ | Is paid when applying for a visa/residence permit. |

| Visa fee (IP) | 173€ | Is paid when applying for a visa/residence permit as an individual entrepreneur. |

| Collection of the National Employment Service (IE) | 110€ / 116€ | Is paid when applying as a sole proprietor |

| Business Registration Tax (Sole proprietor) | 16€ | Is paid after the business is registered as an individual entrepreneur |

| Fee for temporary residence permit (residence permit) | 185€ | Is paid when registering a residence permit in Serbia (required for stays over 90 days) |

| Medical insurance | Depends on policy | It is necessary to have valid medical insurance covering the entire period of stay in Serbia. The cost depends on the plan and the company. |

| Certificate of criminal record | Depends on the country | Required for submitting an application. The cost of receipt depends on the country of issue. |

| Confirmation of the availability of funds in the account (deposit) | About 500€ | Not a direct expense, but a requirement to show the availability of funds equal to about three average salaries in Serbia in a bank account. |

Necessary Documents and Requirements

The following requirements are set for the documents needed to obtain a digital nomad visa in Serbia:

- Application form.

- A copy of a valid passport.

- Medical insurance.

- Two photographs.

- A statement indicating the reason for the visit and the planned duration of stay.

- Documents proving the fact of renting or owning property.

- Bank statement confirming the availability of funds.

- Documents proving the fact of remote employment.

- Confirmation of payment of visa fees.

Typically, the processing time for an application is about 30 days. It is necessary to submit the application no later than 3 months before the planned trip to Serbia.

Recent Changes in Visa Matters in Serbia

In February 2024, Serbia conducted a significant review of its immigration processes and rules. Changes affecting digital nomads included the launch of a new portal for submitting applications for visas and permits, an extension of the validity period, and an easing of the renewal process for issued permits. An official launch of the freelancer visa program is also expected.

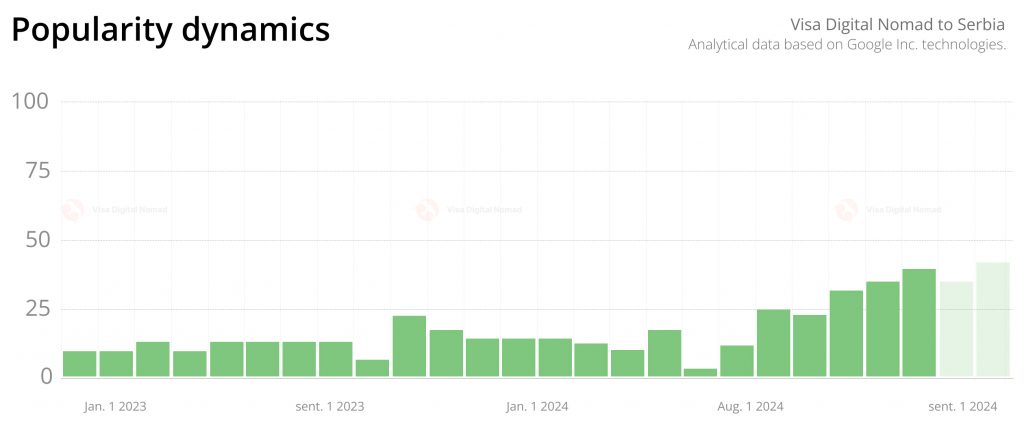

All of the above changes in the program allowed the dynamics of demand for a Serbia visa to reach a new level, reaching a new peak value by August 2024 according to Google Trends.

Frequently asked questions

The validity of the passport must be at least 6 months from the date of filing the visa application. The passport must also have at least 2 blank pages for affixing the visa and stamps.

The health insurance must have a coverage amount of at least €20,000 and be valid for the entire period of the intended stay in Serbia. Regular travel insurance will not do, full medical insurance is required.

The cost of the policy depends on the insurance company, but the average price ranges from 200 to 500€ per year.

For the last 6 months. Evidence may include bank statements, contracts with clients or employers, tax returns, and other financial documents.

The procedure is free, but to activate the account you will need to make a minimum deposit of €50. Some banks charge a service fee of €5-10 per month.

Opening a bank account usually takes one to several business days if all documents are provided correctly.

Yes, after arriving in Serbia, you must register at the local police station within 24 hours. At the same time, you must apply for a temporary residence permit for a stay in the country longer than 90 days.

You must register at your local police station within 24 hours of arriving in the country. The registration process takes several hours (depending on how busy the station is).

Once the application is submitted, the review period is approximately 20 days. Additional time will be required to submit biometric data and receive a residence permit card.

Yes, the applicant must provide documents confirming the fact of renting or owning real estate in Serbia.

The average rent for an apartment in Belgrade is 400-800 €/month. When signing the contract, you will have to make a deposit of 1-2 monthly payments.

Yes, you need to apply for a Serbian Taxpayer Identification Number (TIN). This applies to both self-employed and sole proprietors. We have previously provided more details about Serbian residence permit through individual entrepreneurship.

The process of obtaining a TIN takes several days. In practice, it happens faster.

For the first 183 days, nomads are exempt from taxes. After that, income is taxed at a rate of 10-15% (depending on the type of activity).

The application review period is usually from 15 to 30 days. In some cases (if additional verification or documents are required) the process can be extended up to 45 days.

The application must be submitted no later than 3 months before the intended trip.

The Digital Nomad Visa may be the first step for living in Serbia, but it does not provide a direct path to citizenship. The Nomad visa itself provides a temporary residence permit (residence permit). To obtain citizenship, you will need to go through the naturalization procedure. The process of obtaining a passport through naturalization takes at least 6 years (including the time to obtain permanent residence).